Life Perspectives, Fall 2018

|

|

Fall 2018

VOL 1 | NO 1 |

|

The Academy’s Forthcoming PBR Assumption Resource Manual—a Guide for Those in the VM-20 Trenches By Ben Slutsker

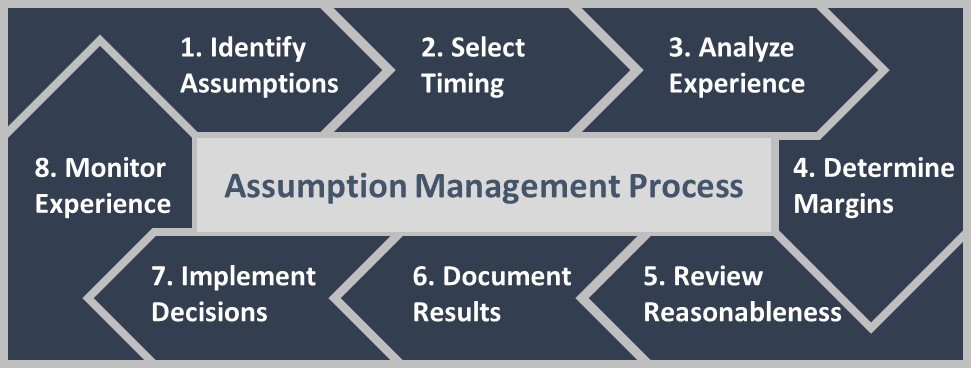

The primary value of the PBR Assumptions Resource Manual will be to provide examples and common practice for VM-20 margin development and governance around applying valuation assumptions, especially for non-mortality liability assumptions (policyholder behavior and expense assumptions in particular). Note that the resource manual is not intended to provide regulatory prescription or guidance, nor does it focus on annuity products or mortality table construction. The background behind this initiative starts with the implementation of VM-20. A company may select the implementation start date for VM-20 between Jan. 1, 2017, and Jan. 1, 2020, to comply with the NAIC Valuation Manual. To date, multiple companies have implemented VM-20 for year-end 2017 and have submitted an associated VM-31 PBR Actuarial Report to their state regulators. In addition, companies that are implementing later in the transition period only have another year remaining, and in many cases, the company has already initiated or are further along the implementation process. Therefore, the idea behind this resource manual was to turn the focus from implementation to the next phase of VM-20—maintaining a recurring valuation process. The Academy plans to release the PBR Assumptions Resource Manual at the end of 2018. In total, the resource manual is expected to be around 70 pages in length. Approximately 40 to 50 pages consists of an eight-step example framework process, with another 20 pages illustrating four case studies. Below is a visual display of the example framework for updating valuation assumptions. The visual sets the structure of the resource manual and is referred to throughout the document.

Each step makes up one section in the document. Below is a summary for each:

In addition, the resource manual contains four case studies on the topic of VM-20 margins:

The resource manual concludes with an appendix that contains a descriptive list of resources that may be referenced in practice, both with respect to VM-20 and assumption development. Ben Slutsker, MAAA, FSA, is chairperson of the Academy’s PBR Assumptions Resource Manual Work Group.

Task Force Comments to NAIC on Life and Health Valuation Law Manual The Academy’s Life and Health Valuation Law Manual Task Force submitted a comment letter to the NAIC Life Actuarial (A) Task Force as a follow-on from its presentation at the NAIC Summer Meeting in Boston outlining recommended changes to the 2019 Life and Health Valuation Law Manual.

Life Practice Council Groups Offer Input to NAIC Two Life Practice Council Groups submitted Academy input to the NAIC on a variety of topics.

Life Groups Comment to NAIC, State Agencies LPC committees and work groups also sent comments on various issues to federal and state governments.

AG43/C3 Phase II Work Group Comments

The AG43/C3 Phase II Work Group submitted three comment letters to the NAIC:

Life Experts Present at Academy’s Annual Meeting and Public Policy Forum

Actuarial Perspectives on 2018 PBR Actuarial Reports On Jan. 1, 2017, principle-based reserving (PBR) for life products was adopted as part of the Valuation Manual. The new PBR approach represented a paradigm shift in how statutory reserves for life products are calculated, utilizing cash flow models and assumptions based on company experience. There is a voluntary, three-year transition to implement the new PBR approach, and several companies elected to implement PBR in 2017 for all or some of their products. Actuaries from these companies that filed PBR actuarial reports with state regulators in early 2018 will provide their perspectives, as well as a summary of the regulators’ review and assessment of these submitted PBR actuarial reports. The Impact of the 2017 Tax Cuts and Jobs Act (TCJA) on Life Insurers The TCJA made changes to general corporate taxation rules that will affect life insurers. The most well-known of these changes is the reduction in the corporate tax rate. But the law also made significant changes that are unique in the taxation of life insurance companies, for example with respect to the calculation of tax reserves. Learn about the ways in which the TCJA impacts life insurers, including with respect to risk-based capital, and what this will mean for actuaries. Pension-Risk Transfers The purchase of insurance company annuities by pension plan sponsors to meet obligations and eliminate future risk (pension risk transfer) has become increasingly common. While there is some public awareness of Pension Benefit Guaranty Corporation protection for pension plans, safeguards and regulations for the insurers that take on these pension obligations are less understood. This session will discuss the regulatory scrutiny of pension risk transfers and their impact on the security of retirement benefits. See the full agenda, including session speakers, for more details. And don’t forget the meeting and forum will also offer plenary sessions featuring high-profile speakers, including Charlie Cook of The Cook Political Report, who will give an informed overview of the U.S. political outlook just days before the midterm elections.

Academy Presents at NAIC Summer Meeting

Chris Trost, chairperson of the C-2 Work Group, gave an update on that group’s projects to the NAIC Life Risk-Based Capital (E) Working Group. The Academy’s presentations to the NAIC’s Life Actuarial (A) Task Force (LATF) included:

|

|

California Gov. Jerry Brown signed a bill into law in September that requires insurers to notify policyholders of flexible premium life insurance policies whenever a policy is subject to an increase in the cost of insurance charge or administrative expense charge. The Louisiana Department of Insurance adopted an amended rule (Title 37 Insurance – Part XIII. Regulations – Chapter 41. Regulation 60―Advertising of Life Insurance) in August removing a requirement that life insurers complete a certificate of compliance for advertisements. Alaska Gov. Bill Walker signed a bill into law in July that implements PBR and language that brings Alaska law up-to-date with the NAIC Credit for Reinsurance Model Law. The Illinois Department of Insurance adopted a rule in July clarifying that certain valuation standards for life insurance do not apply in cases where principle-based valuation is statutorily required in accordance with the NAIC Valuation Manual. The New York Department of Financial Services finalized a rule in July clarifying that the sections of the insurance law that requires any recommended transaction to be in the best interest of the consumer apply to life insurance recommendations as well as annuity recommendations. The Nebraska Department of Insurance adopted an amendment to a rule governing the sale of synthetic guaranteed investment contracts (GICs) in Nebraska. The new rule updates Nebraska regulations to match the current NAIC model regulation. The New York Legislature passed a bill that would implement a valuation manual providing for PBR, subject to the approval of the superintendent of insurance. The bill is now awaiting consideration by Gov. Andrew Cuomo. NAIC Summer Meeting Activities At the NAIC’s Summer 2018 National Meeting in Boston in August, the Executive (EX) Committee and Plenary:

Also, the Life Actuarial (A) Task Force:

|

|

|

Copyright © 2018 American Academy of Actuaries. All Rights Reserved. |

Over 2018, the Academy has been developing a Principle-Based Reserves (PBR) Assumptions Resource Manual. This resource manual aims to provide a step-by-step example framework of the process to update assumptions for life insurance valuation purposes. The primary focus is on the NAIC’s VM-20, Requirements for Principle-Based Reserves for Life Products, but the resource manual may be applicable to other valuation and asset adequacy testing frameworks as well.

Over 2018, the Academy has been developing a Principle-Based Reserves (PBR) Assumptions Resource Manual. This resource manual aims to provide a step-by-step example framework of the process to update assumptions for life insurance valuation purposes. The primary focus is on the NAIC’s VM-20, Requirements for Principle-Based Reserves for Life Products, but the resource manual may be applicable to other valuation and asset adequacy testing frameworks as well. life breakout sessions

life breakout sessions