Symposium Offers Perspectives on Retirement, Social Security

The Academy’s Actuarial Perspectives and Solutions for Strengthening the U.S. Retirement System symposium, held Sept. 18 in the nation’s capital, covered a range of retirement issues, with expert panels exploring Social Security and the roles of both individuals and employers.

The symposium brought together federal policymakers, retirement experts, and actuaries from the Academy’s Retirement Practice Council (RPC) to discuss and share actionable solutions for strengthening the U.S. retirement system and improving retirement outcomes for Americans, with special recognition of Social Security’s 90th year.

Academy Retirement Vice President Jason Russell kicked off the event by reminding attendees that Social Security marked its 90th anniversary in August and that ERISA—the Employee Retirement Income Security Act of 1974, which sets minimum standards for private industry employee health and retirement plans—turned 50 last year. He also noted that today, ensuring retirement security for all faces several major hurdles.

“Most private sector employees do not have access to a defined benefit pension plan, and not everyone is lucky enough to have an employer-provided defined contribution plan,” Russell said. “Many people struggle to save for retirement and, once they get there, it can be a challenge to spend down their account in a way that both provides a comfortable lifestyle and avoids the risk of outliving their savings.”

U.S. Comptroller General Gene Dodaro, who is closing out an almost 50-year career with the agency when his 15-year term leading the U.S. Government Accountability Office (GAO) comes to an end in December, offered opening remarks. He noted that many Academy members have assisted and worked with the GAO, notably Frank Todisco, a past Academy Pension Fellow who now serves as GAO’s chief actuary and will become the Academy’s next president-elect in November. Dodaro also spoke about his longstanding concern that, without strong intervention, the Social Security Trust Fund’s dwindling reserves will be depleted by 2033, forcing about a 23% cut in benefits. He reported that Social Security, along with Medicare, cost more than $1 trillion per year and that the current value of the gap between Social Security’s expenses and revenues over 75 years is about $75 million.

The symposium featured three panels, including: “Social Security at 90: What Will it Look Like at 100?,” led by Sam Gutterman, chairperson of the Academy’s Social Security Committee; “The Role of Individuals: Improving Opportunities and Addressing Challenges,” moderated by Tonya Manning, a member of the Pension Committee; and “The Role of Employers in Retirement Security,” led by Pension Committee Chairperson Grace Lattyak. The symposium concluded with a roundtable discussion featuring congressional staff members and Academy Senior Retirement Fellow Linda K. Stone.

“The symposium was the Academy’s brand in action,” Stone said, bringing together stakeholders in the retirement space and showcasing the RPC’s impactful work . “We have built relationships across the aisle and with stakeholders who are thought-leaders and to bring everyone together in one room was very exciting. The vibe in the room was buzzing as new connections were made and others reconnected. The issues that were discussed and the solutions proffered are of real concern for Americans, about half of whom don’t participate in workplace plans and could be facing about a 20% Social Security benefit cut if Congress doesn’t act.”

Stone, who moderated the congressional panel, said “it was really important for attendees to hear that retirement is a bipartisan issue and that there is a good working relationship between the chairman and ranking member of the Senate Health, Education, Labor and Pensions [HELP] Committee. The RPC has strong relationships with the committees of jurisdiction over retirement issues and the work we do is helpful to these offices as they craft retirement policy.”

Read More—also see the Actuarially Sound blog post recapping the symposium.

RPC Volunteers Visit Federal Agencies

Before the retirement symposium, RPC volunteers and Academy staff visited several key federal agencies, meeting with staff from the Congressional Budget Office (CBO) and Congressional Research Service (CRS) to discuss retirement priorities, including Social Security solvency, defined benefit and defined contribution plans, lifetime income, multiemployer plans, and the RPC’s work overall.

Incoming Retirement VP Bruce Cadenhead Offers Insights

Incoming Retirement Vice President Bruce Cadenhead will begin his two-year appointment during the Academy’s 60th Anniversary Celebration and Governance Transition event on Nov. 21. Cadenhead offered this preview of priority issues for the RPC in the coming year.

“Big picture, I’ve been part of the Pension Committee and am learning about the other committees and their priorities,” Cadenhead said. “Social Security is always a top issue. I think we need to raise the temperature to try to make sure needed changes to the system are addressed sooner, rather than later—anything that we can do to help increase the urgency around finding a solution will be important.”

He noted the issue of Pension Benefit Guaranty Corporation (PBGC) premiums is also a top concern. The RPC has been exploring the issue of PBGC premiums and there is often debate in Washington about whether or not those premiums are too high, the political appetite to address the issue, and what other solutions are viable. The issue, he added, is that it’s “really having a detrimental effect on anyone who is considering maintaining or reopening a DB [defined benefit] plan.”

Beyond those two big issues, following some of the topics coming out of the Academy’s successful retirement symposium in September, the RPC will be “seeing what we can do to support creative plan design ideas that will probably fall in between current DB and DC [defined contribution] plans that would provide meaningful lifetime income,” he said, adding that “I’m still gathering information, so that’s not the whole list.”

Regarding the symposium, Cadenhead added that “the audience was really engaged and there were a lot of good ideas shared, and it was good for making connections related to a lot of the topics I just mentioned. The discussions held during the symposium are going to be helpful in advancing those policy goals.”

Free Livestream for Governance Transition—Academy members can register to attend free livestreams of the Academy’s Nov. 21 Leadership Summit, with opportunities to capture continuing education (CE) credit, watch the governance transition, and celebrate the annual awards presentations.

Issue Brief Examines Social Security & Federal Debt/Deficits

A Social Security issue brief released in late October, The Relationship Between Social Security and Federal Government Deficits and Debt, offers clarity to the confusion around the current and future effects of Social Security finances on U.S. federal government annual deficits and debt.

The brief touches upon how the structure of the public program’s financing adds additional pressure to both the U.S. unified budget deficit and to the need to address the depletion of the trust funds sooner rather than later.

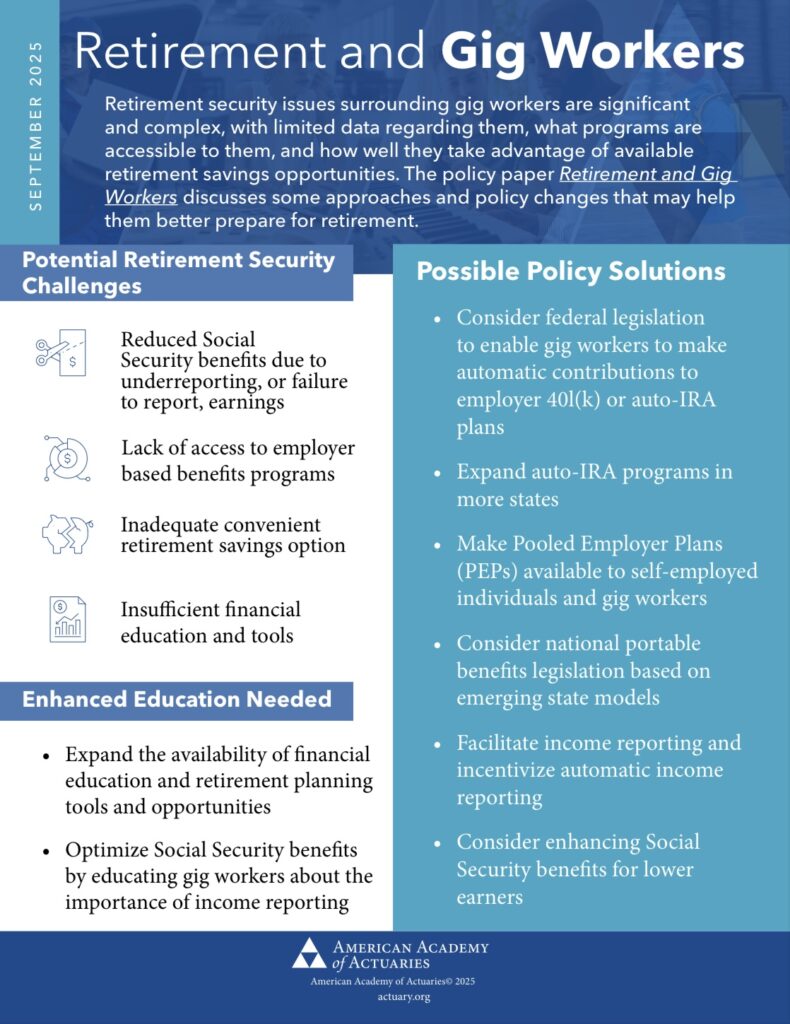

Policy Paper Examines Gig Workers’ Retirement Needs

An RPC policy paper, Retirement and Gig Workers, covers some of the unique retirement challenges faced by gig workers, a growing segment of the U.S. workforce. The policy paper, a joint publication by the RPC’s Retirement Policy and Design Evaluation (RPADE) Committee and Social Security Committee, highlights the public policy considerations connected to gig workers, who are generally doing nontraditional work outside the traditional employer-employee relationship.

Infographic—Accompanying the paper is a one-page infographic, highlighting potential retirement security challenges as well as public policy approaches when addressing gig workers’ retirement needs.

News release—“Many gig workers face diminished prospects of saving for their golden years, compared to those in traditional employment relationships—so it’s important that policymakers be aware of the potential shortfall and options to help address it,” RPADE Committee Chairperson Lee Gold said in the related news release.

Social Security Paper Covers Public-Sector Workers

A policy paper, Public Sector Workers Not Covered by Social Security: Implications for Their Retirement Security, examines how public sector entities seeking exemptions from Social Security must demonstrate compliance by sponsoring a pension plan with benefits comparable to those provided by Social Security.

Webinar Covers Spousal Protections

An Oct. 30 webinar, Improving Spousal Retirement Plan Protections, drew on RPADE Committee’s June issue brief on the topic, exploring gaps in spousal retirement plan protections and proposals to address them.

Speakers included RPADE Chairperson Lee Gold and Vice Chairperson Connie Rydberg, along with Karen Friedman from the Pension Rights Center and Kendra Isaacson from Mindset.

Watch a replay on Academy Learning, and for more detail, see Rydberg’s Q&A in the Summer Retirement Report.

Highlights From

Retirement Report

Prefer watching the news? Check out this “Highlights From Retirement Report” video for a quick recap of what you need to know.

Retirement News in Brief

The Pension Committee submitted a comment letter to the Financial Accounting Standards Board Emerging Issues Task Force, responding to the current agenda project, Application of Topic 715 to Market-Return Cash Balance Plans.

Academy in the News

A Plan Sponsor story exploring the challenges and opportunities of retirement solutions for gig workers included ideas outlined in the Academy’s recent issue brief on the topic.

A column on Social Security’s future in the Montgomery County News (Texas) included reform options identified by the Academy’s Social Security Committee.

Retirement Income Journal covered discussion of the retirement issue brief, Decumulation Strategies: Creating Lifetime Income from Defined Contribution Plans.

The National Institute on Retirement Security’s “Noteworthy from NIRS” bulletin highlighted the issue brief, Public Sector Workers Not Covered by Social Security.

Legislative/

Regulatory Activity

Federal

President Donald Trump issued an executive order on Aug. 7 directing the Department of Labor to examine guidance and provide clarification on the Department’s position on permitting employer-sponsored 401(k) retirement plans to offer alternative investment options for their employees such as crypto currency, private equity, and real estate.

The Senate confirmed Daniel Aronowitz as assistant secretary of labor for the Employee Benefits Security Administration (EBSA), which is responsible for enforcement of ERISA and related laws and regulations.

The Senate unanimously passed two employee stock ownership plan (ESOP)-related bills: S 2403, which attempts to mitigate valuation risk for ESOPs by aligning their valuations with IRS standards and creating a “safe harbor” for trustees; and S 1728, which seeks to expand the ERISA Advisory Council by adding two representatives of employee ownership organizations.

The House Ways & Means Committee approved two bills related to Social Security: HR 5284 directs the Social Security Commissioner to change the Social Security Administration’s (SSA) terminology when describing benefit claiming ages in order to better reflect the implications of claiming decisions; HR 5345 requires the SSA to provide victims of identity theft with a single point of contact at the agency.

Sen. Ruben Gallego of Arizona is sponsoring S 2716, a measure that ends federal taxation of Social Security benefits while raising the cap on those paying into the retirement program. Currently, the salary threshold is $176,100. The bill would create a donut hole where no Social Security taxes would be collected but restart contributions for those making above $250,000.

Sen. Mazie Hirono of Hawaii unveiled S 2614, a bill that would alter the formula used to decide annual increases in payments while also raising the salary limit and phasing in tax increases contributing to the Social Security fund each year. The Social Security Administration estimates the measure would add 11 years to current estimates for how long full benefits could be paid under the program.

Reps. Seth Magaziner of Rhode Island and Ron Estes of Kansas introduced HR 5325, legislation that directs the Department of Labor to issue a regulation that permits retirement plan fiduciaries to transfer unclaimed retirement distributions to state unclaimed property programs.

State

On Oct. 6, California Gov. Gavin Newsom signed AB 1067, amending the California Public Employees’ Pension Reform Act of 2013 by adding a provision related to public employee misconduct and retirement benefits forfeiture due to a felony conviction.

On Oct. 1, Newsom signed SB 853, which makes technical amendments to state code regulating the California State Teachers’ Retirement System, the California Public Employees’ Retirement System, and the County Employees Retirement Law of 1937 retirement systems, including revisions to provisions that speak to workload reduction agreements for members of the defined benefit plan.