Retirement Report, Fall 2024

Vol 7 | No. 3

Date:09/01/2024

Q&A-Immigration & Social Security

The Social Security Committee released a public policy issue paper, Immigration and Social Security, which discusses the importance of immigration to the financial evolution of Social Security.

“In line with the American Academy of Actuaries’ public-service mission, this new issue paper is a resource for all who are looking for a clear, detailed, and actuarially informed explanation of immigration’s effects on this vital program, which supports financial security for tens of millions of older and disabled Americans,” said Sam Gutterman, chairperson of Social Security Committee, in an Academy news release.

To shed more light on this topic and the new issue paper, Retirement Report did a Q&A with Gutterman on the issue paper and immigration’s impacts on Social Security.

The paper distinguishes between lawful permanent residents, or LPRs, and other-than-LPRs. Acknowledging that we’re approaching a political minefield, how are these populations projected to change in the years ahead? How do both cohorts contribute to Social Security’s finances?

The simple answer to the first question is that the future of immigration is uncertain-the uncertainties involve future immigration policy and execution, as well as the relative economic, climate, and employment prospects between the United States and other countries. The trustees of the Social Security system expect net annual new LPR immigrants of about 600,000 and net annual other-than-LPRs of about 450,000, with about 450,000 new LPRs who were previously in the other category.

Lawful permanent residents can participate in Social Security through covered employment, and after working a defined number of years can then collect benefits. Thus, for several decades after entry, they only contribute positively to the finances of the system. Those who are not here lawfully cannot participate, although some do contribute to the system through fraudulent means (e.g., using a deceased person’s Social Security number)-but if done in that way, they will not be able to collect corresponding benefits; if they become a lawful immigrant at a later time, they may be able to receive credit for their earlier contributions if they can demonstrate they actually contributed.

What are some of the differences between LPRs and other-than-LPRs-that is, the idea that this isn’t solely focused on the undocumented, but rather a reminder that there are several categories of people who for a variety of reasons have come to the country to work and are taxed, even if they don’t have citizenship status-including the fact that we’re talking about students and those with work visas.

There have always been a large number of lawfully admitted immigrants. There are several categories of LPRs-the major ones are immediate family members and those who are family-sponsored, employment-sponsored, refugees, and admitted under diversified programs mainly from Central America. They are treated the same as the native-born-many work in covered employment, contribute to the system through payroll taxes, and receive benefits when eligible. In addition, millions of people are in the country as tourists, seasonal workers, and students, most of whom have little or no involvement with Social Security.

The paper offers some detailed statistics about migration with respect to U.S. population growth and fertility rates. What are some of the key takeaways in this area with respect to Social Security’s long-term health?

The key takeaway is the positive role that immigrants play in the financial soundness of the Social Security system. Because our overall population has experienced improved mortality and lower-than-replacement fertility rates, without immigration we would experience a declining workforce, resulting in a lower contribution base to support the tens of millions of Social Security beneficiaries.

An interesting and often-discussed trendline is shown in Table 3, about the projected decline in workers per Social Security beneficiary. It notes that the ratio fell from over 3 in 1970-2008 to about 2.7 today, and will gradually decline to 2 in 2070 before ticking up again. What can you say about some of the implications to Social Security’s solvency in the short, medium, or long term? How can immigration mitigate this trend?

The primary drivers of the decrease in workers per Social Security beneficiary have been decreasing fertility rates and improving mortality rates. Offsetting these drivers has been a high level of immigration over the 90 years of the system’s existence. The relatively young set of immigrants (median age under the age of 30) provides a more immediate favorable financial effect than other sources of new entrants to the system-that is, births. Thus, covered employment by lawful permanent resident immigrants makes an immediate contribution to the system’s finances. Their children’s future earnings will also contribute over the long term to the system. Without immigration, the workers per Social Security beneficiary would decrease more rapidly and would be less than 2.0.

One of the paper’s conclusions notes that although immigration overall benefits Social Security’s finances, the largest part of the solution to the program’s actuarial deficit must come from other sources. How much of a factor is immigration to shoring up Social Security in the long term?

Regardless of the level of immigration, the system’s current trust fund will continue to decline. Under the assumed rate of immigration, the combined OASDI [Old-Age, Survivors, and Disability Insurance] trust funds are projected by the systems’ trustees to become depleted by around 2035, which will result in a significant reduction in benefits. Without the support of immigrants, the depletion date would be somewhat earlier. Immigration will remain a significant factor, although the extent of this contribution will depend on many interrelated factors.

What about the impacts/effects felt by emigrants? The Academy also has a paper on the gig economy in the works, which feeds into the increase in the number of native-born citizens working outside of the country or outside of the traditional norms that could also feed into the solvency of Social Security.

For the most part, emigrants continue to receive earned benefits, no matter where they live. Emigration can, however, affect some people’s eligibility for benefits, because benefit eligibility for retirement benefits requires at least 40 quarters of covered earnings. Those who emigrate before meeting the benefit eligibility requirements will not receive benefits. Work in countries with which the United States has a totalization agreement can fill benefit gaps for persons who have divided their careers between the United States and another country. In contrast, those who work in the informal economy or whose earnings are not covered do not receive Social Security benefits.

Academy ‘ERISA at 50′ Series Continues

Retirement Practice Council (RPC) members attended the Sept. 12 ERISA 50th Anniversary Symposium & Gala in Washington, D.C., marking this month’s 50th anniversary of the Employee Retirement Income Security Act of 1974 (ERISA). The Academy was part of the event’s Research Committee, with Senior Retirement Fellow Linda K. Stone an active member.

Single-Employer Issue Paper

The Pension Committee released an issue paper, ERISA: 50 Years of Shaping the Single-Employer Defined Benefit Landscape. It discusses the broad impacts of the Employee Retirement Income Security Act of 1974 on the retirement landscape, focusing specifically on the single-employer space. The issue brief is included in the ERISA at 50 group above’s Digital Research Journal.

Webinar Looks at Multiemployer Plans

Continuing the Academy’s “ERISA at 50” series marking the landmark law’s anniversary, an Aug. 29 webinar, ERISA at 50: Multiemployer Perspectives From the Past to the Future, featured a panel of experts discussing the unique features of multiemployer plans.

December Webinars to Look at Capital Markets, Surplus Considerations

Save the date for a Dec. 3 webinar, Retirement Capital Markets Update, that will look at the latest in capital markets in a retirement context.

A Dec. 12 webinar will provide additional illumination on a recently issue brief, ‘Surplus’ Considerations for Public Pension Plans. Speakers will provide an overview of the brief and put context around the term “surplus,” as well as describe various surplus management strategies. Register now.

Webinars Examine PBGC Premiums, Church Plans

A Sept. 17 webinar, Rethinking the PBGC Premium Structure, explored changes to the single-employer premium structure to better align with the PBGC’s mission. Presenters also gave an overview of the differences in the PBGC’s single-employer and multiemployer programs.

Church plans & GAO

A July 30 webinar featured a panel of U.S. Government Accountability Office (GAO) officials who reviewed two publications on church plans-an Academy issue brief and a GAO report. Senior Retirement Fellow Linda K. Stone moderated.

JBEA Seeks Actuarial Examination Advisory Committee Members

The Joint Board for the Enrollment of Actuaries (JBEA) is seeking applications for the Advisory Committee on Actuarial Examinations for a term from March 1, 2025, to Feb. 28, 2027. The committee plays an integral role in assisting the JBEA in offering examinations that test the knowledge necessary to qualify for enrollment. Applications are due Dec. 1-visit the IRS/JBEA webpage for information on how to apply.

Actuaries Longevity Illustrator Updated With New Look & Feel

The Academy and the Society of Actuaries (SOA) have updated the Actuaries Longevity Illustrator, an online tool that helps users with a vital aspect of financial planning for retirement.

Originally launched in 2016, the illustrator now has a more consumer-friendly mobile version, making it easier than ever to calculate the impact of an important factor in retirement planning: longevity risk.

“Achieving financial security in retirement isn’t just a question of the assets you’ve accumulated, but critically involves other questions like how long they may need to last,” said Academy Senior Retirement Fellow Linda K. Stone. Read the news release.

Visit the illustrator-longevityillustrator.org-and share it with your family, friends, and colleagues.

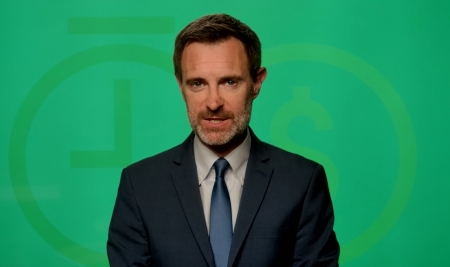

Eric Keener Among New Member-Selected Directors

KeenerLongtime Retirement Practice Council volunteer Eric Keener is among three of recently member-selected volunteers who will become Academy Board members in November. For more, visit the Board Selection Center.

Keener chaired the Retirement Policy and Design Evaluation Committee and drove the Academy’s series of policy documents on national retirement income. He has also moderated and participated in many Academy webinars and has been active in the annual “Hill visits”-meetings with federal lawmakers and regulators.

Candidate statement excerpt-“I have a strong interest and commitment to broader public policy and professionalism issues and hope to bring practical perspectives to Board discussions on how the Academy can best offer independent, nonpartisan actuarial input to public policymakers.” See Keener’s full bio.

Issue Briefs Cover Collective Defined Contributions, Lump Sums

The Retirement Policy and Design Evaluation Committee released an issue brief, Collective Defined Contribution Plans, which defines Collective Defined Contribution (CDC) plans broadly, and discusses advantages and criticisms of CDC plans.

The Public Plans Committee released an issue brief, Public Pension Plans: Helping Members Evaluate Buyout Programs and Other Lump Sums, which offers critical information that would help members compare the value lump-sum payments to the value of the lifetime benefits.

Policy Paper Explores Retirement Outcomes

The Retirement Policy and Design Evaluation Committee released a policy paper, Improving Retirement Outcomes: Demographic Considerations, which discusses retirement inequities and how current retirement plan design elements and policies may inadvertently disadvantage certain cohorts of individuals. Also published-a related executive summary.

Highlights From Retirement Report

Prefer to watch your news? Check out this “Highlights From Retirement Report” video for a quick recap of what you need to know.

Envision Tomorrow

Retirement Sessions

Unable to attend next week’s Envision Tomorrow in person? A Digital Pass offers access to all general and select breakout sessions. Register today for the Academy’s annual meeting, being held Oct. 15-16 in Washington, D.C.

An Oct. 16 general session, “Shaping the Future: Changing Longevity from a Risk to an Opportunity,” will feature AARP Chief Public Policy Officer Debra Bailey Whitman and Academy Board member (and incoming health vice president) Annette James, who will hold a cross-practice “fireside chat” on longevity issues.

Retirement breakout sessions, both of which are on Oct. 16, will be “A Return to Defined Benefit Pension Plans?” and “Reforming Social Security Sooner Rather Than Later: What Will the Next Congress and President Face? What Are the Options?” The Social Security breakout session will be livestreamed and include Academy volunteers and Social Security Administration officials. See the full agenda.

Former NATO Supreme Allied Commander Gen. Wesley Clark will give the opening keynote address on leadership, global risks, and the U.S. political landscape, and financial and insurance inclusion researcher Leroy Nunery II will lead a discussion on “Growing Financial Inclusion.”

Also at the meeting, a general session “Bridging the Insurance Gaps: A View From the States,” will feature NAIC CEO Gary Anderson and NAIC President Andrew Mais.

A professionalism general session will explore the foundational concept of self-regulation in the U.S. actuarial profession with opening remarks by Center for Industry Self-Regulation Executive Director Justin Conno.

CNBC presidential election coverage included a story citing comments by Academy Social Security Committee Chairperson Sam Gutterman on the issue of immigration and Social Security, following the committee’s recent issue brief on the subject.

Retirement Vice President Jason Russell helped mark ERISA’s 50th anniversary with comments featured in Pensions & Investments‘ anniversary-day coverage on Labor Day.

A Kiplinger personal finance story on the 50th anniversary of ERISA featured comments from Pension Committee Vice Chairperson Lloyd Katz on historical factors affecting the market for traditional pensions.

ABC TV affiliate WJLA (Washington, D.C.) ran a National Desk segment on retirement issues that included comments from Senior Retirement Fellow Linda K. Stone on the newly revamped Actuaries Longevity Illustrator, developed jointly by the Academy and the Society of Actuaries. The segment aired on more than 80 outlets. CNBC covered the illustrator in a story that was reprinted by NBC New York and others. AARP also cited the tool.

A subscriber-only MarketWatch opinion piece highlights the new issue paper on immigration and Social Security.

A discussion of in-plan annuity options published by Retirement Income Journal cited analysis from a 2020 issue brief.

The Academy’s work outlining the potential consequences of waiting to address Social Security’s financial challenges was highlighted in a Newsweek story warning readers of possible future benefit cuts.

A Tribune Content Agency column reported on the newly revamped Actuaries Longevity Illustrator, developed jointly by the Academy and the Society of Actuaries. The columnist also highlighted the tool on WGN-AM (Chicago) talk radio.

FedSmith– a news and information site for federal government employees-recommended the Actuaries Longevity Illustrator to its readers. Kiplinger also published a story on the illustrator.

MSN‘s ongoing coverage of Social Security issues in this year’s presidential election included Academy analysis of reform options.

Newsweek used Academy analysis in an explainer article on the effect of immigration on Social Security finances.

Barron’s and MSN cited remarks from the Academy’s recent webinar on the Social Security Trustees Report.

The Academy provided historical context of the multiemployer system’s financial condition toThe Courier-Post‘s (Cherry Hill, N.J.) reporting on federal assistance to distressed pension plans in New Jersey.

Legislative/Regulatory Activity

Federal

The IRS released final rules raising the age workers must start taking funds out of their qualified retirement accounts to between 70.5 and 75 years, depending on date of birth. The required minimum distribution age changes will allow workers to leave more cash in retirement accounts to accrue savings.

The House Appropriations Committee passed HR 9029, legislation that provides about $185.8 billion in discretionary spending for the Labor, Education, and Health and Human Services departments for fiscal year 2025. It also provides funding for the Social Security Administration and Pension Benefit Guaranty Corporation (PBGC).

The IRS issued final regulation requiring plan sponsors of a single-employer defined benefit plan to obtain agency approval to use mortality tables specific to the plan in calculating present value for minimum funding purposes, such as a substitute for the generally applicable mortality tables. These regulations affect participants in and beneficiaries of certain retirement plans and employers maintaining those plans.

The Employee Benefits Security Administration released an interim final rule on May 17 amending the Abandoned Plan Program regulations that provide streamlined procedures for the termination of and distribution of benefits from individual account pension plans that have been abandoned by their sponsoring employers. These interim final rules expand the regulations to cover individual account pension plans whose sponsors are in liquidation under Chapter 7 of the U.S. Bankruptcy Code, so that bankruptcy trustees may use the Abandoned Plan Program’s streamlined procedures to terminate and wind the plans up.

State

Rhode Island Gov. Dan McKee signed HR 7127, creating an automatic individual savings account for all working adults currently not offered retirement benefits through their employer. The program will be administered by the state’s general treasurer.

Kansas Gov. Laura Kelly signed SB 1, exempting Social Security benefits from state income tax. The language was a part of a broader bill revamping the state’s tax system.

A New York judge dismissed a lawsuit filed against New York City pension funds over their decision to sell billions of dollars in fossil-fuel investments. N.Y. State Supreme Court Justice Andrea Masley said in a July 3 order that plaintiffs lacked standing, as they are members of a defined-benefit pension plan entitled to a fixed payment every month and, therefore, wouldn’t be harmed by the divestment decision.

New Jersey Gov. Phil Murphy signed S 3371, revising the limits for net cash surrender and net cash withdrawal values from $100,000 to $250,000 for certain annuity policies and contracts.

Retirement Public Policy in Brief

The Prudential Regulation Committee (PRC) sent a comment letter to the NAIC’s Capital Adequacy (E) Task Force on the exposure draft of Risk-Based Capital Preamble, 2024-16-CA.

The PRC submitted comments to the International Association of Insurance Supervisors on IAIS’ public consultation on climate risk supervisory guidance-ICP guidance and supporting material.

The Social Security Committee released an issue brief offering an actuarial perspective on the 2024 Social Security Trustees Report.

The Social Security Committee and the Retirement Policy and Design Evaluation Committee sent a comment letter to the Senate Committee on Health, Education, Labor and Pensions on portable benefits for self-employed workers.