1850 M Street NW

Suite 300 Washington, DC 20036 202-223-8196 | www.actuary.org Craig Hanna, Director of Public Policy © 2018 American Academy of Actuaries. All rights reserved. |

|

| Members of the Social Security Committee include: Janet Barr, MAAA, ASA—chairperson; Robert Alps, MAAA, ASA; Douglas Eckley, MAAA; Gordon Enderle, MAAA, FSA, EA; Ronald Gebhardtsbauer, MAAA, FSA, EA; Amy Kemp, MAAA, ASA, EA; Jeffrey Leonard, MAAA, FSA, EA; Leslie Lohmann, MAAA, FSA, FCIA, EA, ECA; Gerard Mingione, MAAA, FSA, CERA, EA; Jeffery M. Rykhus, MAAA, FSA; and Joan Weiss, MAAA, FSA, EA. |

click here.

click here.

|

The Social Security Trustees Report is a detailed annual assessment that serves as a basis for discussions of Social Security’s financial problems and their solutions. Social Security’s chief actuary prepares and certifies the financial projections for the Old-Age, Survivors, and Disability Insurance program, under the direction of the Social Security Board of Trustees.

Because future events are inherently uncertain, the report contains three 75-year financial projections to illustrate a broad range of possible outcomes. These projections, each based on a different set of assumptions, are referred to as intermediate, low-cost, and high-cost. The report also provides a sensitivity analysis for key assumptions and a projection based on a probability model (i.e., a stochastic forecast). The trustees consider the intermediate projection to be their best estimate. All information in this issue brief is based on the intermediate projection, unless otherwise noted. |

| New Trustees Report Shows OASDI Trust Fund Depleted in 16 Years Social Security’s Financial Soundness Should Be Addressed Now |

||||||||||||||||||||||||||||||||||

The 2018 Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance (OASI) and Federal Disability Insurance (DI) Trust Funds highlights that:

|

|

|||||||||||||||||||||||||||||||||

The sooner a solution is implemented to ensure the sustainable solvency of Social Security, the less disruptive the required solution will need to be.

|

||||||||||||||||||||||||||||||||||

When trust fund reserves are depleted, tax income will be sufficient to provide about 75% to 80% of the scheduled benefits. The Social Security Trustees Report quantifies the value of the benefit and/or tax changes required to restore actuarial balance. Any changes would require congressional action. Failure to act would likely cause a delay in some benefit payouts, which, if not corrected by subsequent congressional action, could result in benefit reductions. However, it should be noted that there is no precedent and no legislative guidance for what would happen if reserves are fully depleted.

Overview of Financial Status

Short-Range Estimates, 2018–2027

Short-range financial adequacy is measured separately for the Old-Age and Survivors Insurance (OASI) and the Disability Insurance (DI) programs, as well as for the combined Old-Age and Survivors Insurance and Disability Insurance (OASDI) trust funds. The trustees have adopted a test for short-range financial adequacy1 based on projected trust fund ratios. (A trust fund ratio is the ratio of the trust fund assets at the beginning of the year to the benefits payable during the year.) The OASI fund and the combined OASDI fund meet the short-range financial adequacy test while the DI fund fails the test.

Social Security’s short-range OASDI financial projection is worse than the projection made a year ago. The OASDI trust fund ratio is expected to drop from 288 percent at the beginning of the projection period to 137 percent in the 10th year of the projection period. Last year, the projected OASDI fund ratio in the 10th year was 165 percent. The total change in the projected 10th-year trust fund ratio is a decline of 28 percentage points (165 percent declining to 137 percent). Moving the short-range estimate period one year forward alone caused a decline of 18 percentage points. A reconciliation of the changes in the projected 10th-year trust fund ratio from last year to this year is as follows:

- Moving the short-range estimate period forward one year reduced the fund ratio by 18 percentage points.

- Changes in economic data and assumptions reduced the fund ratio by 16 percentage points.

- Effect of Tax Cuts and Jobs Act of 2017 and assumed discontinuance of the Deferred Action for Childhood Arrivals (DACA) policy reduced the fund ratio by 5 percentage points.

- Changes in demographic data and assumptions increased the fund ratio by 2 percentage points.

- Changes in programmatic data and assumptions increased the fund ratio by 9 percentage points.

|

Any excess of tax income over outgo is recorded as an asset reserve of the Social Security trust funds. These trust fund asset reserves are held in special U.S. Treasury securities that totaled $2.9 trillion at the end of 2017 and represent the government’s commitment to repay the borrowed funds whenever Social Security needs the money. For the first time since 1982, trust fund asset reserves are expected to decrease during the next year. Trust assets are projected to decrease by $1.7 billion during 2018 (total income including earnings on trust fund assets is projected to be less than benefit payments during 2018) and then are projected to continue to decline throughout the remainder of the short-range estimate period and beyond.

Income and Cost

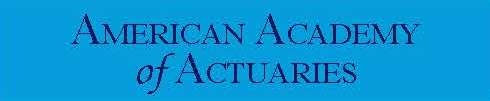

Figure 1 above shows the excess/(deficit) of income over cost since 1975. The excess of income over cost has created the current $2.9 trillion in trust fund asset reserves. Starting in 2018, the OASDI trust fund is projected to begin a decline until exhaustion. The current Social Security Trustees Report projects the OASDI trust fund to be depleted in 2034 under the intermediate assumptions.

Long-Range Estimates, 2018–2092

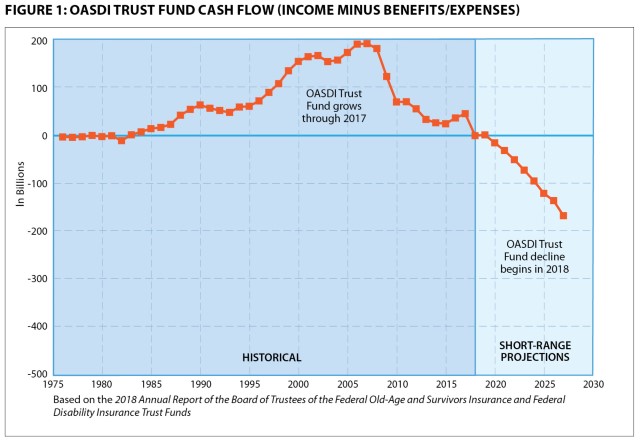

Long-range estimates are based on a 75-year projection that covers the future lifetimes of nearly all current participants (those paying payroll taxes and those already retired) along with future expected participants in the program. The estimates show that, beginning in 2034, trust fund asset reserves are projected to be depleted and the system is expected to revert to a fully pay-as-you-go (PAYGO) system. This date is the same as shown in last year’s report. After reserves are depleted in 2034, Social Security income will be sufficient to pay 79 percent of scheduled benefits initially. This ratio decreases to 74 percent by 2092.

|

The projections show expenditures exceeding non-interest income in every year (as has been the case since 2010) and rising rapidly through 2035 as the Baby Boomers retire. While costs are expected to increase quickly, tax revenue is also expected to grow, but more slowly. After 2035, projected costs are fairly level as a share of both gross domestic product (GDP) and taxable payroll.

Actuarial balance conveys the long-range solvency of Social Security in one number. It is the present value over the 75-year projection period of all income less all costs (including the maintenance of a 1-year cost reserve at the end of the 75-year period), divided by the present value of the taxable payroll over the same period. This ratio represents the average annual amount (expressed as a percent of taxable payroll) by which income would need to change to have trust fund assets equal to one year of scheduled benefits at the end of the 75-year projection period. The actuarial balance worsened, from a negative 2.83 percent to a negative 2.84 percent, from the 2017 to the 2018 Trustees Report. Refer to the appendix for an expanded definition of actuarial balance.

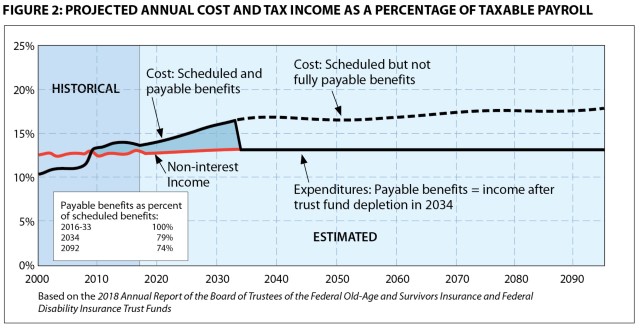

The long-range expected increase in Social Security program costs relative to program income is caused principally by demographic trends. These demographic trends are very well known and are generally referred to as “aging” or, sometimes, as “the aging of America.” It is useful to further separate the aging trend into two components:

- macro-aging, which is observed at the population level and refers to a shift in the age distribution of the population caused by the large decrease in birth rates beginning in the mid-1960s (the fertility drop after the large Baby Boom generation); and

- micro-aging, which can be observed at an individual level and refers to the expected long-term increase in life expectancies caused by individuals living longer, on average, in each succeeding generation.

A third demographic component, which acts to partially offset macro-aging, is net immigration. Because immigrants tend to be younger than the average covered OASDI worker, higher immigration can offset some of the change in the age distribution of the population caused by lower birth rates.

|

Achieving Sustainable Solvency

In order to achieve viability of Social Security in the foreseeable future, any modifications to the system should include sustainable solvency as a primary goal. Sustainable solvency means that not only will the program be solvent for the next 75 years under the reform methods adopted, but also that the trust fund reserves at the end of the 75-year period will be stable or increasing as a percentage of annual program cost. Refer to the appendix for a more complete explanation of sustainable solvency.

Providing for solvency beyond the next 75 years will require changes to address micro-aging, as beneficiaries will likely be receiving benefits for ever-longer periods of retirement.

Regardless of the types of changes ultimately enacted into law, measures to address Social Security’s financial condition will best serve the public if implemented sooner rather than later. Some advantages of acting promptly are:

- Announcing changes to Social Security far in advance of implementation gives future beneficiaries time to plan for all aspects of retirement and modify their own financial planning.

- Implementation of program changes can be more gradual and span multiple generations of retirees.

- Public trust in the financial soundness of the Social Security program will improve.

Providing for solvency both during and after the period where the macro-aging trend impacts Social Security requires a timely and thoughtful solution. At the same time that changes address the Baby Boom bulge, consideration should be given to address the ongoing micro-aging trends.

Appendix

Measures of Financial Status

The metrics used by the trustees to present the program’s financial status are discussed in more detail below.

Actuarial balance is calculated as the difference between the summarized income rate and the summarized cost rate over a period of years. The summarized income rate is the ratio of any existing trust fund plus the sum of the present value of scheduled tax income for each year of the period to the sum of the present value of taxable payroll for each year of the period. The summarized cost rate is the ratio of the present value of cost for each year of the period, including one year’s outgo at the end of the period, to the sum of the present value of taxable payroll for each year of the period. “Achieving actuarial balance” means having a non-negative actuarial balance. Table 1 shows the components of actuarial balance.

TABLE 1: LONG-RANGE ACTUARIAL BALANCE

(percentage of taxable payroll)

|

In the 75-year period, 2018–2092, the actuarial deficit is 2.84 percentage points. The actuarial deficit increased from the comparable figure of 2.83 percentage points a year ago due to a combination of factors, including changes in demographic data and assumptions, changes in economic data and assumptions, and legislative and policy changes.

An immediate increase of 2.78 percentage points in the payroll tax (from 12.4 percent of payroll to 15.18 percent of payroll), a benefit reduction of about 17 percent, or some combination of the two, would pay all benefits during the period, but would not end the period with any trust fund reserve.

The high-cost 75-year projection in the Trustees Report shows a far greater actuarial deficit—6.62 percent of taxable payroll. The low-cost projection is much more favorable, with a small positive actuarial balance for the 75-year period.

Trust Fund Ratios

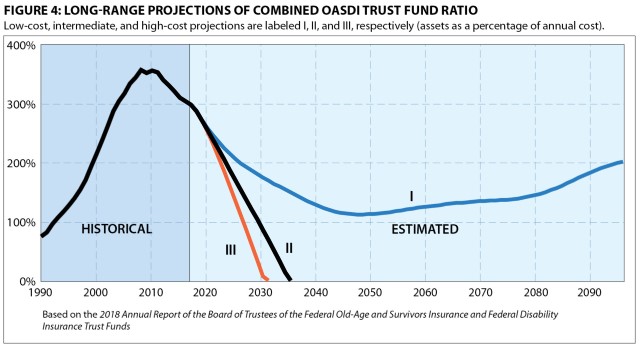

The trust fund ratio, equal to trust fund assets as a percentage of the following year’s cost, is an important measure of short-term solvency. A trust fund ratio of at least 100 percent indicates the ability to cover the expected scheduled benefits and expenses for the next year without any additional income. Figure 4 shows projected trust fund ratios under all three sets of assumptions.

|

Sustainable Solvency

Sustainable solvency means the program is not expected to deplete reserves any time in the 75-year projection period, and trust fund ratios are expected to finish the 75-year projection period on a stable or upward trend.

Sustainable solvency is a stronger standard than actuarial balance in two ways. First, actuarial balance is based on averages over time, without regard to year-by-year figures that could indicate inability to pay full benefits from trust fund assets at some point along the way. Second, a positive actuarial balance can exist even when trust fund ratios toward the end of the period are trending sharply downward.

Sustainable solvency, in contrast, requires strict year-by-year projected solvency and trust fund ratios that are level or trending upward toward the end of the period. For example, following the last major Social Security reform in 1983, the 1983 Trustees Report projected a positive actuarial balance under the intermediate assumptions, but the annual balances (annual difference between the income rate and the cost rate) were negative and declining at the end of the 75-year period. That report showed a positive actuarial balance but did not show sustainable solvency. As a result, the actuarial balance generally has been declining since then, primarily as a consequence of the passage of time. It is important to note that this result was exactly what the Trustees Report projected in 1983. More than 30 years later, it should be no surprise that large and growing actuarial deficits are now projected at the end of the long-range projection period. Adequate financing beyond 2092, or sustainable solvency, would require larger program changes than needed to achieve actuarial balance.

Unfunded Obligation

The unfunded obligation is another way of measuring Social Security’s long-term financial commitment. To compute it, the year-by-year streams of future estimated cost and income are discounted with interest and then summed to obtain their present values. Based on these present values, the general formula for computing the unfunded obligation is:

| Present value of future cost (benefits and expenses) minus the present value of future income from taxes minus current trust fund assets. |

The dollar amount of unfunded obligation is easier to interpret if put in perspective—for example, by comparing it with the size of the economy over the same period. The unfunded obligation is often presented as a percentage of the present value of either taxable payroll or of GDP. At the beginning of 2018, the open-group unfunded obligation over the next 75 years was $13.2 trillion (up from $12.5 trillion last year). This now represents 2.68 percent of taxable payroll (2.66 percent last year), or 1.0 percent of GDP (0.9 percent last year).

In recent years, the Trustees Reports have also presented the unfunded obligation based on stretching the 75-year projection period into infinity.

The infinite horizon projections project all annual balances beyond 75 years assuming that the current law, demographic assumptions, and economic trends from the 75-year projection continue indefinitely; in practice, this is highly problematic. Projections over an infinite time period have an extremely high degree of uncertainty. Troublesome inconsistencies can arise among demographic and program-specific assumptions. By assuming that longevity keeps increasing forever while retirement ages remain static, for example, the infinite time period forecast will eventually result in an extremely long period of retirement.

Measures of Uncertainty

Because the future is unknown, the trustees use alternative projections and other methods to assess how the financial results may vary with changing economic and demographic experience.

Alternative Sets of Assumptions

Table 2 shows a comparison between recent values and ultimate long-range values of five key assumptions used in each of the three projections. Fertility, productivity growth, and real-wage growth ultimate values have not changed from last year’s report. The ultimate values of the mortality reduction assumption exhibit some slightly smaller reductions when compared to last year’s Trustees Report. The ultimate values for annual net immigration have decreased in part due to a Department of Homeland Security clarification regarding the expected number of future legal permanent residents.

TABLE 2: CURRENT AND LONG-RANGE VALUES OF KEY ECONOMIC AND DEMOGRAPHIC ASSUMPTIONS

Based on the 2018 Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds |

|||||||||||||||||||||||||||||||||||||||

The low-cost and high-cost projections change all the major intermediate assumptions at once in the same direction, either favorably or unfavorably. In contrast, there might be some interest in how the projections change when only one key assumption is changed at a time, either favorably or unfavorably. A sensitivity analysis shows exactly this. Just one assumption is changed at a time to determine the financial impact. Table 3 gives results of three sensitivity tests focusing on total fertility rate, mortality reduction, and real-wage growth. A significant component of the differences between low-cost, intermediate, and high-cost projections is the real-wage growth (specifically the difference between inflation and real wages, or the real-wage differential). Actuarial balances as well as the projected depletion dates change materially based on changes to this component.

TABLE 3: SENSITIVITY TO VARYING ANY OF THREE KEY ASSUMPTIONS

Based on the 2018 Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

If the real-wage growth assumption were changed from 1.20 percent to 1.82 percent, for example, the actuarial deficit would be reduced from 2.84 percent of taxable payroll to 1.78 percent, and the year of trust fund asset reserve depletion would be extended from 2034 to 2037.

References

Annual Trustees Report and related Social Security Administration publications (http://www.ssa.gov/OACT/pubs.html)

American Academy of Actuaries issue briefs on Social Security

- Social Security – Automatic Adjustments (May 2018)

- Women and Social Security (May 2017)

- Helping the ‘Old-Old’—Possible Changes to Social Security to Address the Concerns of Older Americans (June 2016)

- Social Security Disability Program: Shortfall Solutions and Consequences (August 2015)

- Social Security Individual Accounts: Design Questions (May 2014)

- Quantitative Measures for Evaluating Social Security Reform Proposals (May 2014)

- A Guide to Analyzing Social Security Reform (December 2012)

- Means Testing for Social Security (December 2012)

- Understanding the Assumptions Used to Evaluate Social Security’s Financial Condition (May 2012)

- Significance of the Social Security Trust Funds (May 2012)

- Automatic Adjustments to Maintain Social Security’s Long-Range Actuarial Balance (August 2011)

- Raising the Retirement Age for Social Security (October 2010)

- Social Security Reform: Possible Changes to the Benefit Formula and Taxation (June 2010)

- Social Security: Evaluating the Structure for Basic Benefits (September 2007)

- Investing Social Security Assets in the Securities Markets (March 2007)

- A Guide to the Use of Stochastic Models in Analyzing Social Security (October 2005)

- Social Adequacy and Individual Equity in Social Security (January 2004)

- Annuitization of Social Security Individual Accounts (November 2001)

| 1. | The test of short-range financial adequacy for a trust fund is met if, based on the intermediate assumptions, (1) the estimated trust fund ratio is at least 100 percent at the beginning of the period and remains at or above 100 percent throughout the 10-year short-range period or (2) the ratio is initially less than 100 percent, reaches at least 100 percent within five years (without reserve depletion at any time during this period) and remains at or above 100 percent throughout the remainder of the 10-year short-range period. |

| 2. | The results shown in the Actuarial Balance column may not be equal to the difference between Summarized Income Rate and Summarized Cost Rate because of rounding. |