Learn about the 10 key competencies that enable chief actuaries to drive success in insurance companies across all sectors.

By Ken Avner, Jack Burke, William Cashion, Patrick Getzen, Dave Nelson, Keith Passwater, Dan Rachfalski, Stafford Thompson, Jr., Kate Tottle, and Karena Weikel

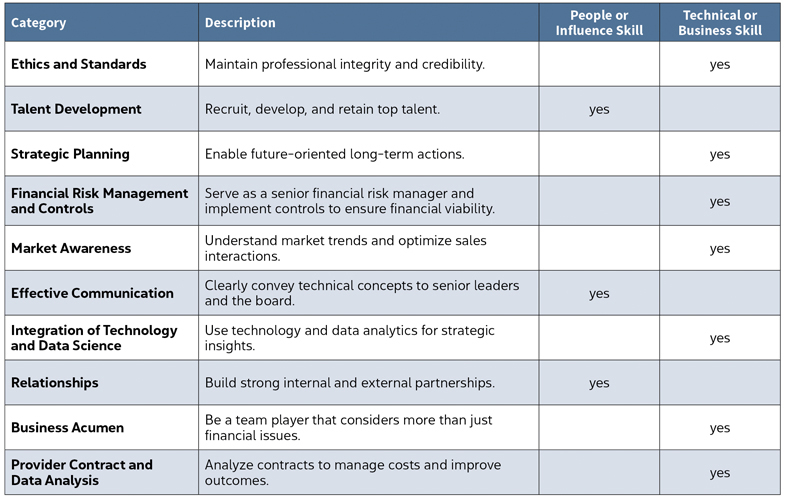

What makes a chief health actuary effective? To find the answer, we surveyed 10 actuaries with 300+ combined years of industry experience and 50+ years as chief actuaries managing billions in premiums. Their perspectives helped us identify 10 key competencies for chief health actuaries, which in turn help define the skills needed to succeed in the chief actuaries roles.

While this article is primarily intended for aspiring chief health actuaries and draws from our experience in health insurance, the insights provided are valuable to anyone seeking to understand how chief actuaries, whether in health or other practice areas, contribute to the success of insurance companies across all sectors.

Every chief actuary needs a strong skill set, but the demands of the job differ based on company-specific factors, such as:

- Company size: Leadership in larger firms requires extensive delegation, while smaller firms require a more hands-on approach.

- Business model: Provider-owned plans call for closer involvement with providers than traditional insurers.

- Organizational structure: Successful actuaries adapt to and align with key leaders to foster effective partnerships.

The topics discussed below are primarily ordered by importance, with adjustments for logical flow.

Ethics and Standards

Beyond education and training, an occupation becomes a profession through accountability to others, adherence to defined standards, a commitment to a code of ethics, and a disciplinary process that reinforces an adherence to these professional elements. Chief actuaries must uphold Actuarial Standards of Practice (ASOPs) and ethical principles, ensuring that all actuarial work meets professional and regulatory expectations. By doing so, they reinforce trust and deliver high-quality, reliable work products. They also empower their teams to ask the right questions and seek accurate answers, guiding decision makers toward sound insights grounded in observations. The goal of actuarial science is to move beyond assumptions, impressions, and conjecture. As John Ruskin’s quote reminds us: “The work of science is to substitute facts for appearances and demonstrations for impressions.”

Talent Development

Chief actuaries develop actuarial talent by focusing on key behaviors and skills, including building trust, developing strong analytical abilities, promoting effective communication skills, and enhancing business acumen. Encouraging continuous learning and offering diverse project opportunities are essential to building a strong team. Leaders must adopt a growth mindset, engage in talent calibration, and ensure both a strong technical base and a leadership pipeline through strategic succession planning. Creating a collaborative culture and empowering employees by avoiding micromanagement helps attract and retain top talent, ensuring the team is well-equipped to meet demands of the role, adapt to the evolving business environment, and contribute to organizational success.

Strategic Planning

Strategic planning is a critical skill for the chief actuary due to the impact the actuarial team has on the company’s performance. In many ways, the chief actuary must demonstrate the value of the actuarial team or risk being replaced. Demonstrating value involves having clear deliverables, developed using meaningful feedback from leaders across the company, along with key performance indicators (KPIs) to measure and report on successes. There should be a direct link between the actuarial team’s deliverables and the company goals. The actuarial strategic planning process should optimize current business results while anticipating future market conditions. A flexible framework that works both today and tomorrow helps position the actuarial team as strategic partners to the company’s leadership.

Financial Risk Management and Controls

The chief actuary is a senior financial risk officer responsible for developing and refining processes to proactively manage pricing risks and cost trends. While they routinely collaborate with the CFO and enterprise risk management teams, their actuarial staff often serves as the company’s primary safeguard against significant unforeseen financial disruptions. Exceptional leaders also monitor distribution, operational, regulatory, and legal risks, while identifying new risks on the horizon. In short, the chief actuary is always focused on company risk.

Equally important, outstanding chief actuaries understand the need to look inward for risk as well. They establish effective control mechanisms to ensure accuracy and prevent errors in the work produced by the actuarial team.

Market Awareness

Actuaries drive financial predictability by tracking current cost drivers-such as the focus on GLP-1 drugs and gene therapies-while anticipating future shifts in health care services. Comparing emerging and historical financial trends with those of competitors helps enhance awareness of potential regulatory responses to industry profit levels Furthermore, effective chief actuaries utilize financial analysis and public policy expertise to drive strategic planning and regulatory influence.

Forward-thinking actuaries anticipate how regulators might respond to rate requests and develop strategies to explain trend drivers and market shifts-whether they are one-time anomalies or persistent patterns, and whether they impact only their company or the industry as a whole.

To maintain a competitive edge, chief actuaries must help position their company as the preferred partner for members, providers, brokers, and consultants through improvements in technology, customer relations, and product sales/service.

Effective Communication

For chief actuaries, the technical skills we bring to a table are useless if they are not paired with effective communication. Understanding the situation, framing its essence, analyzing alternatives, and quantifying risks-often with ranges when the risk is significant-are all important aspects of the actuary’s contribution. However, unless leading a technical discussion with other actuaries, the ability to summarize is the essential product.

The best chief actuaries transform complex technical analysis into clear, concise communications. They ensure that senior leaders, the board, and other stakeholders understand the key risks and assumptions in all critical actuarial work products.

Integration of Technology and Data Science

Chief actuaries play an important role in a company’s data, analytics and technology strategy. Establishing and maintaining close partnerships with the chief information officer (CIO), the chief data officer (CDO), and the chief technology officer (CTO) are essential to equip the actuarial team with high-quality data and cutting-edge technology. These partnerships enable the actuarial team to maximize value by leveraging a full range of information sources, from base level reporting to advanced analytics. With tools like artificial intelligence and machine learning, actuaries gain deeper insights that drive better decision making. This capability allows for a comprehensive understanding of member and provider behavior, leveraging both outlier detection and traditional averaging methods to identify key patterns.

Relationships

Relationships are a long-standing leadership competency. These connections go beyond personal ties; they are mutual business networks that support career growth. They are built through joint projects, selfless support of colleagues, and even informal conversations over a meal.

These networks are also enduring. Two business colleagues can go a decade without speaking and then reconnect to further their careers. Key professional partnerships often span IT, underwriting, consulting, reinsurance, actuarial peers at other firms, and most importantly, senior leaders within one’s organization.

Ultimately, building business relationships is a leadership competency that enables actuaries to grow into executive roles, such as chief actuary.

Business Acumen

Chief actuaries must be strategic leaders, broadening their business and financial acumen to complement their technical skills. At times, this involves embracing “calculated risks” and supporting growth rather than defaulting to conservatism. Chief actuaries need to align their decisions with the organization’s growth and financial objectives by thinking holistically and applying sound business judgment. A proven history of financial balance enables the company’s actuaries to credibly pursue necessary actions when cost trends accelerate.

Provider Contract and Data Analysis

Actuaries improve financial outcomes in provider arrangements through data-driven analysis. They assess contracts, collaborate with clinicians, explain findings, and offer recommendations.

Provider contracting and data analysis can be particularly challenging for a chief health actuary. Actuaries, who play a pivotal role in financial quantification, often collaborate with teams that are largely focused on clinical or academic issues. Building mutual respect and understanding each department’s priorities helps minimize conflicts and promotes effective dispute resolution. As a respected senior leader, transparency and professionalism help the chief actuary to maintain a supportive culture while striving for optimal decisions.

Actuaries in provider-aligned health plans play a key role in advancing value-based care by improving quality, affordability, and patient outcomes. Their analytical insights identify emerging trends, while providers often identify real-time opportunities that would take months or years to appear in data. Strong communication and genuine collaboration with providers-especially those receptive to actuarial insights-enhance both actuarial impact and care delivery. By leveraging data and fostering meaningful partnerships, actuaries help their company build trust, and drive cost-effective, high-quality health care.

Setting an Example of Self-Awareness and Self-Care

Being a chief actuary is a demanding role that requires self-awareness and setting the right example. Effective leaders recognize their strengths and weaknesses, acknowledge their limits, and build teams that complement their skills. This fosters collaboration, improves performance, and creates a positive work environment.

Equally important is personal well-being: spending time with family, enjoying hobbies, getting enough sleep, eating well, and exercising helps leaders stay focused and resilient. Self-care isn’t a luxury, it’s essential. Leaders who push to exhaustion risk burnout and send the wrong message to teams who are always watching.

Conclusion

The insights shared by experienced chief actuaries illustrate the multifaceted demands of the role and the diverse mix of competencies and skills needed to be successful-strategic thinking, data-driven decision making, effective communication, and strong leadership. As a senior financial risk officer, the chief actuary helps lead the organization through the complexities of the health insurance landscape.

Ken Avner, MAAA, FSA; Jack Burke, retired MAAA, retired FSA; William Cashion, ASA; Patrick Getzen, MAAA, FSA; Dave Nelson, MAAA, FSA; Keith Passwater, MAAA, FSA; Dan Rachfalski, MAAA, FSA; Stafford Thompson, Jr., MAAA, FSA; Kate Tottle, MAAA, FSA; and Karena Weikel, MAAA, ASA