Retirement Report, Spring/Summer 2024

Vol 7 | No. 2

‘ERISA at 50’ Kicks Off With Webinar, Symposium

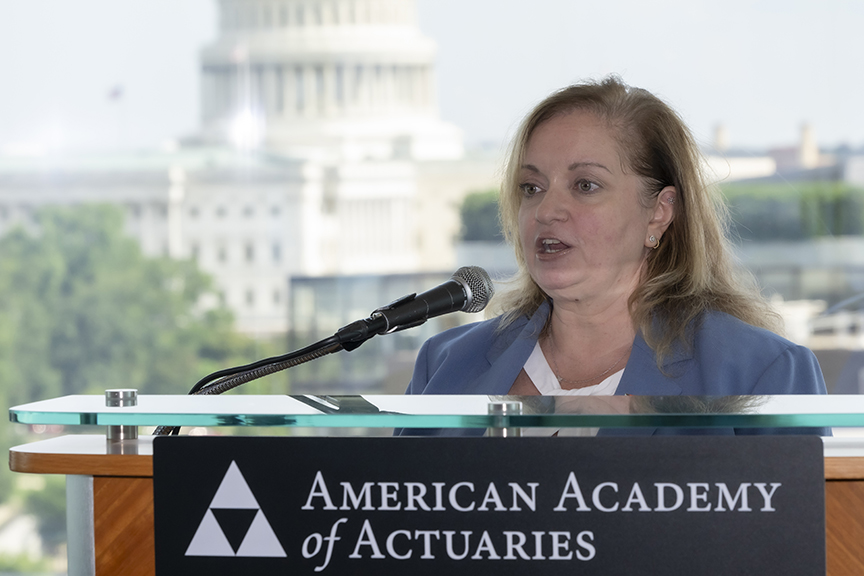

Featured Speaker—EBSA Assistant Secretary Lisa Gomez

EBSA’s Lisa Gomez addresses the symposiumThe Academy’s “Looking Back, Moving Forward: ERISA at 50” series marking the 50th anniversary of the Employee Retirement Income Security Act of 1974 (ERISA) kicked off with a May 14 webinar that looked at the landmark law’s history, followed by the June 4 stakeholder symposium in Washington, D.C. The symposium featured a series of speakers discussing ERISA’s framework, offering insights on its subsequent evolution, and looking ahead to the future of retirement in the U.S. For more on the webinar, see the Actuarially Sound Academy blog. (Webinar slides and audio are available free on the Academy website.)

“We wanted to invite external stakeholders to this symposium to discuss these important issues, while at the same time showcasing the work that the Retirement Practice Council has done to provide our unique actuarial insights to help move this conversation forward to action that will help Americans to secure their retirement future,” said Academy Senior Pension Fellow Linda K. Stone.

The symposium’s closing keynote speaker was U.S. Employee Benefits Security Administration (EBSA) Assistant Secretary Lisa Gomez, who likened the law to a person turning 50, with attendant milestones, and challenges, in their life.

The symposium’s closing keynote speaker was U.S. Employee Benefits Security Administration (EBSA) Assistant Secretary Lisa Gomez, who likened the law to a person turning 50, with attendant milestones, and challenges, in their life.

“ERISA is a law that has provided so many protections and innovations over the past 50 years,” Gomez said. Relating it to a person, “What has she done that was good, what has she done that was not so good, and what can we look forward to?” she said, humorously adding that “we have to give her a lot of support, because she’s going through a midlife crisis, like so many of us do.”

Gomez thanked actuaries for their contributions to the agency’s charge of “adding color to the black-and-white text of ERISA.” She also noted the challenge that many Americans don’t have retirement savings or are not taking advantage of plans available to them. “You’re all playing very crucial roles” in helping with that, she said.

She also discussed EBSA’s recently released retirement security rule on the definition of an investment advice fiduciary, which she described as a signature achievement of the Biden administration. The rule, which will take effect in September, applies when financial services providers give investment advice to retirement plan participants, individual retirement account owners, and plan officials responsible for administering plans and managing their assets.

A symposium session on ERISA’s historyThe symposium also featured several panels of actuaries and thought leaders who offered insight on ERISA, featuring Academy Retirement Vice President Jason Russell and Pension Committee Chairperson Grace Lattyak. Senior Retirement Fellow Linda K. Stone moderated an opening panel setting the stage, in which speakers offered historical and up-to-date big-picture looks at the law and retirement issues in general.

“I thought Secretary Gomez’s remarks were quite good,” said Russell, who moderated a panel on “Moving Forward—Achieving Employee Retirement Income Security in a Changing Landscape.”

“I think we’ve got a great opportunity here to make changes to help how employers can help their employees have a secure retirement,” Russell said in an interview following the symposium. “That’s really why I volunteer with the Academy—because of the dialogue we have with policymakers, understanding the interests of stakeholders, which can help everyone come to a sensible, practical decision that helps the public interest.”

Lattyak, who moderated the second session, “At Present—Retirement Security Today: Experience of Plan Participants and Plan Sponsors,” said she was pleased with the symposium turnout and the variety of backgrounds and perspectives presented by speakers.

“We were able to cover topics from retirement plans and those employees covered by the single-employer system and how it’s working for them—generally well, although some tweaks could be made to make them even better, provide additional security, and make sure people are aware of their benefits,” she said.

“In the future, a lot of the conversation was about using those benefits that are available most effectively through decumulation. That’s really a big focus of the [RPC] as we think about what’s next,” both in the ERISA at 50 series and going forward, Lattyak said.

For those working with sponsors of retirement plans, it can be easy to overlook that half of American workers do not participate in any employer-sponsored plan, panelists said, while noting innovations such as state-sponsored auto-IRA programs and proposed legislation that is trying to address this issue.

Panelists in the ‘Changing Landscape’ sessionJohn Scott from The Pew Charitable Trusts discussed the increasing numbers of gig workers and the difficulty of saving for retirement without an employer-sponsored plan. Amy Matsui from the National Women’s Law Center pointed out challenges faced by women—lower pay, and sometimes years out of the workforce for childcare, for example, which can translate directly into challenges to financial security in retirement, exacerbated by women’s longer life expectancy.

“One of the big things we heard today is more a convergence of DB [defined benefit]- and DC [defined contribution]-type plans,” said Lloyd Katz, vice chairperson of the Pension Committee, who was a presenter at both the webinar and the symposium. “I think that’s one of the things we’ll keep hearing in the future—we heard that at some of our agency visits this week too,” he said in an interview following the symposium (see story, below).

J. Mark Iwry was also a panelist in both the webinar and the symposium. Iwry, a nonresident senior fellow at the Brookings Institution and a former senior advisor to the U.S. Secretary of the Treasury for national retirement and health policy, offered some thoughts on ERISA’s evolution in an interview following his symposium panel, noting that some of its key changes came at about the halfway point in the late 1990s.

“Perhaps the dominant phenomenon in the 50 years since ERISA has been the decline of defined benefit pension plans and the rise of 401(k) plans,” Iwry said. “There was a key inflection point midway through that half-century, which was the deliberate, policy-driven reform of the 401(k) from the earlier do-it-yourself [DIY] variety to an automatic 401(k)—the difference being that the earlier version shifted more risk onto the individual.”

When he was at the Treasury Department in 1998, Iwry noted that he and his team did not see a “silver bullet” for reviving DB plans directly but did see a way to improve DIY 401(k) plans that were growing rapidly at the time—in part by covering more of the workforce though automatic enrollment, and permitting default options on how much to contribute and on how to invest.

Academy Executive Director Bill Michalisin chats with Gomez at a reception following the symposiumTreasury issued guidance defining and approving automatic enrollment and automatic investing in plans, and decided not to over-regulate it—but “promoted it on the theory that it could bring DIY 401(k) plans back to some semblance of an actual retirement plan—with the benefits of thoughtful plan design with default (automatic) options informed by professionals and experts retained by plan sponsors,” he said.

That history, and the efforts that continue today and that were discussed at the symposium, are “designed to restore the pension to our private pension system, bringing back into the 401(k) some of the advantages and strengths of a pension plan—including a predictable, monthly payout in retirement, as opposed to the typical lump sum offered by a 401(k),” he said. “So, soup-to-nuts, there’s been an effort at about the midway point between ERISA and the present to transplant key virtues of the DB pension into the 401(k).”

Webinar coming in August—Next up in the series: an Aug. 29 webinar on the “View from Multiemployer Plan Perspective.” The series will continue through the fall, with additional webinars and published materials, including an issue brief that will focus on the impact ERISA has had on health insurance. For more information, visit the ERISA at 50 webpage.

Retirement Practice Council Visits Federal Agencies

RPC volunteers and Academy staff at CBORetirement Practice Council (RPC) volunteers, along with Senior Retirement Fellow Linda K. Stone, and Retirement Policy Analyst Philip Maguire, visited government agencies in early June. Visiting the Congressional Research Service (CRS), Congressional Budget Office (CBO), and Government Accountability Office (GAO), the team shared recent RPC work products, learned about agency priorities and upcoming projects, and discussed timely issues in the retirement and Social Security areas.

Topics covered included:

- CRS—the Defined Contribution Subcommittee’s work on annuity products in the defined contribution space, which is something CRS is interested in.

- CBO—Work in the individual equity area, and single-employer plans.

- GAO—Consumer protection and retirement security issues, with some specifics on plan design innovation.

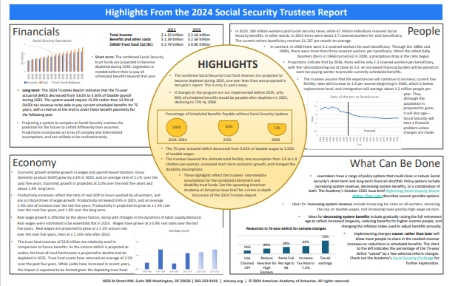

Academy Gets Active Following Social Security Trustees’ Report

The Social Security Committee released a one-page infographic following the release of the annual Social Security Trustees Report in early May. An Academy alert included updated projections on the solvency of the program’s trust funds, which are projected to have sufficient revenue to pay benefits until 2035, one year later than estimated in last year’s report. In 2035, annual revenue will be sufficient to fund 83% of scheduled benefits, and the 75-year actuarial deficit for the combined trust funds is estimated at 3.5% of taxable payroll, down slightly from last year’s report.

The Social Security Committee released a one-page infographic following the release of the annual Social Security Trustees Report in early May. An Academy alert included updated projections on the solvency of the program’s trust funds, which are projected to have sufficient revenue to pay benefits until 2035, one year later than estimated in last year’s report. In 2035, annual revenue will be sufficient to fund 83% of scheduled benefits, and the 75-year actuarial deficit for the combined trust funds is estimated at 3.5% of taxable payroll, down slightly from last year’s report.

Following the release of the report, Social Security Administration Chief Actuary Stephen Goss and Deputy Chief Actuary Karen Glenn presented in a May 22 webinar, moderated by Academy Social Security Committee Chairperson Sam Gutterman. Goss and Glenn offered a deep dive into the assumptions of the Trustees Report and shared how recent developments, like updated data on inflation and output, are reflected in the projections. View the webinar on the Academy’s YouTube page.

The Academy’s ongoing Social Security work received extensive media coverage:

- Senior Retirement Fellow Linda K. Stone discussed the benefits of earlier, gradual reform of Social Security in a CNN story, and CNBC’s and AARP’s coverage quoted Stone on how demographic trends may affect the program.

- Barron’s covered Goss’ and Glenn’s presentations from the webinar.

- InsuranceNewsNet covered the webinar, and a Newsweek cited the Academy in a story highlighting the financing shortfall.

- A Motley Fool explainer on FICA taxes used Academy analysis to illustrate how potential changes in the taxes could impact Social Security’s financial condition.

- MSN’s ongoing coverage of Social Security issues in this year’s presidential election included Academy analysis of reform options.

- The Academy’s analysis of reform options was used to inform a call-in discussion of the trustees report on C-SPAN’s public affairs program, Washington Journal.

- Newsweek and Yahoo Finance cited findings from the October Social Security Committee issue brief, Reforming Social Security Sooner Rather Than Later. A separate Yahoo! Finance story covering of the top presidential candidates’ approaches to Social Security, and a discussion of reform options in Entrepreneur, featured analysis from the issue brief.

Monograph, Issue Brief Examine Individual Equity and Social Adequacy

The Social Security Committee released an updated monograph and issue brief that provide updated measurements of individual equity and social adequacy of Social Security benefits under current law for certain birth and retirement age cohorts. The publications also compare the potential impact on individual equity and social adequacy of three Social Security reform proposals.

Issue Brief Examines ‘Surplus’ in Public Pension Plans

The Public Plans Committee released ‘Surplus’ Considerations for Public Pension Plans, an issue brief that examines what plan “surplus” means and does not mean, historical lessons for public plans, and considerations for plans at or approaching 100% funding in the future. A “surplus” management strategy may include contribution adjustments, risk reduction strategies, and benefit enhancements, intended to preserve the current plan “surplus” and/or reduce the risk of future funded status and contribution volatility.

JBEA Extends CPE Physical Presence Requirement Waiver

The Joint Board for the Enrollment of Actuaries (JBEA) announced it “is retroactively extending the temporary waiver of its physical presence requirement for continuing professional education (CPE) programs and is proposing regulations to eliminate this in-person requirement altogether.” Read the JBEA news release.

Issue Brief Looks at PBGC Single-Employer Premiums

A Pension Committee issue brief, Aligning the PBGC’s Single-Employer Premium Structure With Its Objectives, discusses ways to better align Pension Benefit Guaranty Corporation (PBGC) premiums for the single-employer defined benefit insurance program, while preserving a strong level of retirement security.

“The PBGC’s single-employer program plays a vital role in protecting pension benefits in private-sector defined benefit plans,” said Pension Committee Chairperson Grace Lattyak. Read the Academy news release.