Life Perspectives, Summer/Fall 2024

Vol 7 | No. 2

Over the past two years, the Academy has been working closely with the National Association of Insurance Commissioners (NAIC), the American Council of Life Insurers (ACLI), and more recently EY (Ernst & Young Global Ltd.) to develop and ultimately execute an industry-wide field test examining revisions made to Section 22 of the NAIC’s Valuation Manual. The Academy’s Annuity Reserves and Capital Subcommittee (ARCS) has provided substantial support to NAIC’s Life Actuarial (A) Task Force (LATF) throughout its efforts to implement principle-based reserving (PBR) for non-variable annuities in Section 22 of the Valuation Manual (commonly known as VM-22).

Over the past two years, the Academy has been working closely with the National Association of Insurance Commissioners (NAIC), the American Council of Life Insurers (ACLI), and more recently EY (Ernst & Young Global Ltd.) to develop and ultimately execute an industry-wide field test examining revisions made to Section 22 of the NAIC’s Valuation Manual. The Academy’s Annuity Reserves and Capital Subcommittee (ARCS) has provided substantial support to NAIC’s Life Actuarial (A) Task Force (LATF) throughout its efforts to implement principle-based reserving (PBR) for non-variable annuities in Section 22 of the Valuation Manual (commonly known as VM-22).

In total, the ARCS has submitted and/or presented more than 10 times to LATF on various draft elements of VM-22. In preparation for the 2021–2022 field test, ARCS engaged WTW (Willis Towers Watson) to assist in developing reasonable assumptions for the standard projection amount (SPA), which was ultimately presented to the LATF’s VM-22 Subgroup for consideration. ARCS also drafted preliminary field-test specifications, which were exposed for comment in December 2023 and March at the NAIC Spring National Meeting. For more, see the Academy’s Life Public Policy page and LATF’s webpage.

Since then, members of ARCS along with Academy, NAIC, ACLI, and EY staff have been meeting regularly to discuss the details of the field test, which officially began on July 31 and will run through Sept. 30. The Academy, NAIC, and ACLI are joint sponsors, with assistance from EY. During the fourth quarter of this year, the results will be aggregated, analyzed, and anonymized so that they can be shared publicly. In the first half of 2025, the results will be discussed by regulators and VM-22 will be revised accordingly. Assuming timely approval by the various NAIC committees during 2025, the revised VM-22 will then become effective Jan. 1, 2026.

Investment Actuaries’ Corner—Asset-Backed Securities

Work continues on developing a long-term, life risk-based capital (RBC) framework for residual tranches of asset-backed securities (ABS) (see “Investment Actuaries’ Corner” in the Spring Life Perspectives). The Life Investment and Capital Adequacy Committee’s C1 Subcommittee is providing critical research and analysis to support this initiative.

Work continues on developing a long-term, life risk-based capital (RBC) framework for residual tranches of asset-backed securities (ABS) (see “Investment Actuaries’ Corner” in the Spring Life Perspectives). The Life Investment and Capital Adequacy Committee’s C1 Subcommittee is providing critical research and analysis to support this initiative.

ABS have been available to investors for decades. They developed primarily as a source of housing credit beyond banks, the traditional source of consumer mortgage loans. Cash flows from these mortgages were structured to attract a broad range of investors by customizing cash flows and risk profiles, resulting in more consumer access to housing loans. In more general terms, cash flows are generated from an underlying pool of assets referred to as “the collateral.” The collateral is often still consumer loans, but also includes commercial loans and can be as diverse as aircraft lease receivables, railcar revenue, or energy plant investments.

Collateral assets themselves are not often a fixed set but can be a fund with an objective and a period of reinvestment. That period is the length of time from issue, where cash flows received from the collateral that are greater than the amount of cash required to meet obligations are reinvested into the structure. The ABS structure matures after the reinvestment period is completed and all the asset cash flows from the remaining collateral have been distributed to investors.

ABS cash flows are structured or securitized into tranches, each with its own characteristics and risks. Tranches with designed fixed-income cash flow patterns are called debt tranches, which pay out in a defined order. A debt tranche with the least risk is referred to as the senior tranche—sometimes AAA-rated—with subsequent tranches referred to as junior tranches, with ratings declining with the seniority of the tranches.

Cash flows not designated for debt tranches have the least seniority and are assigned to the last tranche, the residual or equity tranche. Residual tranche cash flows are not well defined and may not be rated. The work of the C1 Subcommittee is to provide a recommendation to determine the appropriate RBC charges for a subset of ABS, collateralized loan obligations, including the residual tranche. The committee expects to have an update for the NAIC Fall National Meeting in Denver but does not expect to be finished with the project until early to mid-2025.

Academy Presents at NAIC Summer Meeting

Life Policy Analyst Amanda Barry-Moilanen at NAICAs part of its charge to engage with external stakeholders, Academy volunteers and staff attended and presented on a variety of professionalism and public policy topics at the NAIC Summer National Meeting in Chicago in mid-August.

Life activity included presentations to NAIC’s Life Actuarial (A) Task Force (LATF), discussing current work products, including the Generator of Economic Scenarios (GOES) project, which was the topic of a July Academy webinar (see story, this issue). Life Policy Analyst Amanda Barry-Moilanen presented to LATF on current and future Academy Life Practice Council (LPC) workstreams.

The Academy also updated LATF on the drafted life appointed actuary knowledge statements, in response to a LATF request last November. Academy President Lisa Slotznick, President-Elect Darrell Knapp, and Rhonda Ahrens walked the regulators through the draft and noted that additional drafted language for qualified actuaries and illustration actuaries will be forthcoming. Following the presentation, LATF Chair Rachel Hemphill (Texas) posted the draft language for a 30-day public comment period. The Academy will complete its work on the three life actuary knowledge statements, along with a drafted health appointed actuary knowledge statement for the NAIC’s Health Actuarial (B) Task Force, and submit final draft versions at the NAIC Fall National Meeting in Denver.

Representatives from the Academy’s Committee on Qualifications (COQ), Actuarial Standards Board (ASB), and Actuarial Board for Counseling and Discipline (ABCD) also gave brief professionalism updates on current activities to LATF, as well as to the Health Actuarial (B) Task Force (HATF) and Casualty Actuarial and Statistical (C) Task Force (CASTF).

Recording available—Want to know more about what happened in Chicago—and what’s up next for the NAIC Fall National Meeting in Denver? Hear from the Academy’s Public Policy department about the latest in casualty, health, life, risk management/financial reporting, and research in the “National NAIC Meeting Recap: Summer 2024,” available on the Academy’s YouTube page.

Life Underwriting Researcher Receives Academy’s 2024 Award for Research

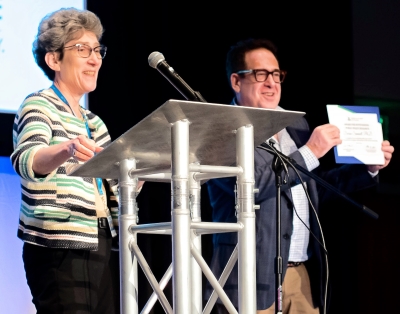

Doron Samuell was presented with the Academy’s 2024 Award for Research by Academy President Lisa Slotznick at the Actuarial Research Conference (ARC) on July 19.

Slotznick and Samuell at the ARCThe award recognizes work by an early-career scholar who is significantly contributing to an actuarial perspective on a public policy issue of interest to U.S. actuaries. Samuell co-authored the research paper, Counteracting Dishonesty Strategies: A field experiment in life insurance underwriting, which he presented in the Academy-sponsored ARC panel on behavioral economics. Samuell will also be recognized at the Academy’s Annual Meeting, Envision Tomorrow, and be part of a research panel to discuss his findings. Read the Academy news release.

Actuaries Longevity Illustrator Updated With New Look & Feel

The Academy and the Society of Actuaries (SOA) have updated the Actuaries Longevity Illustrator, an online tool that helps users with a vital aspect of financial planning for retirement—longevity risk. Originally launched in 2016, the jointly developed illustrator now has a more consumer-friendly mobile version, making it easier than ever to calculate the impact of this important factor in retirement planning.

“Achieving financial security in retirement isn’t just a question of the assets you’ve accumulated, but critically involves other questions like how long they may need to last,” said Academy Senior Retirement Fellow Linda K. Stone. Read the Academy press release.

Visit longevityillustrator.org, and share it with your family, friends, and colleagues.

Academy Presents at SOA Life Meeting

An SOA session

An SOA session

Academy staff and volunteers attended and presented at the Society of Actuaries (SOA) Valuation Actuary Meeting in New York in late August. Life Practice Council volunteers hosted diverse breakout sessions ranging from VM-22 updates to reinsurance issues; an “A for AA” session on asset-focused areas for the appointed actuary; and recent LPC presentations to the NAIC, including an update on the GOES project, the subject of a July Academy webinar. See the presentations on the Life Public Policy page.

Webinar Examines NAIC GOES Project

A July 24 life webinar offered an update on the NAIC Generator of Economic Scenarios (GOES) project, the NAIC’s transition from the Academy’s Interest Rate Generator (AIRG) to a new economic scenario generator. Speakers presented the latest on the project, including recent updates and remaining challenges. Slides and audio are available as a free member benefit.

Academy Holds Successful PBR Bootcamp in Philadelphia

The 2024 PBR Bootcamp, held in person in Philadelphia in June, covered topics including assets, liability assumptions, modeling reserves, hedging, governance, valuation manual updates, and other principle-based reserving (PBR) topics for life actuaries.

“PBR has been in development for a long time … [and] the Bootcamp was developed by the Academy to leverage the expertise of many of the developers and early adopters,” said Donna Megregian, Life Products Committee chairperson and a PBR Bootcamp facilitator.

PBR Member Resources—A reminder that as a member benefit, webinars are archived and available free of charge—including last year’s all-digital PBR Bootcamp series. Dive into the archive to brush up on PBR topics. Also, see the PBR in Practice website, which includes a PBR Toolkit, NAIC resources, practice notes, and more.

Limited Space Available to November’s LHQ Seminar

There’s still time to register for the 2024 Life and Health Qualifications Seminar, set for November just outside of Washington, D.C. Space is limited for the seminar, to be held Nov. 4–7 at the Hyatt Regency Crystal City in Arlington, Va.

The annual seminar delivers three days of training and instruction—plus an optional exam on the fourth day—to equip you with the knowledge you need to gain necessary qualifications to issue actuarial opinions for either the NAIC Life and A&H Annual Statement (Blue Blank) and/or NAIC Health Annual Statement (Orange Blank). It also can serve as a basic education refresher or as a source of required continuing education for more experienced actuaries. Register today.

Events Page—For information on other highlighted educational events and resources, visit the Academy website.

ASB Approves Exposure Draft of a Proposed New ASOP on Reinsurance Pricing

The Actuarial Standards Board (ASB) approved an exposure draft of a proposed new actuarial standard of practice (ASOP), Pricing Reinsurance or Similar Risk Transfer Transactions Involving Life Insurance, Annuities, or Long-Duration Health Benefit Plans.

The Actuarial Standards Board (ASB) approved an exposure draft of a proposed new actuarial standard of practice (ASOP), Pricing Reinsurance or Similar Risk Transfer Transactions Involving Life Insurance, Annuities, or Long-Duration Health Benefit Plans.

The ASB recognized that pricing of reinsurance assumed for life, annuities, and health benefit plans as well as management of nonguaranteed reinsurance elements are significant areas of practice that lacked guidance, and appointed a task force in April 2021 to develop a new ASOP.

The ASB appreciates comments and suggestions on all areas of the proposed standard as well as feedback on questions, including whether the ASOP scope appropriately covers reinsurance pricing involving life and annuity products. Comments are due by Nov. 1—to comment, see the exposure draft.

ASOP No. 40 Revision Approved

The ASB also adopted a revision of ASOP No. 40, Compliance with the NAIC Valuation of Life Insurance Policies Model Regulation with Respect to X Factors. The ASOP provides specific guidance for actuaries complying with requirements consistent with the NAIC Valuation of Life Insurance Policies Model Regulation (Model); actuaries complying with requirements that differ materially from the model should apply the guidance in the standard to the extent appropriate.