Presidential Remarks at Envision Tomorrow 2024, Oct. 15, Washington, D.C.

Over the past year, I’ve shared much about the Academy’s prolific work in my columns in Contingencies magazine.

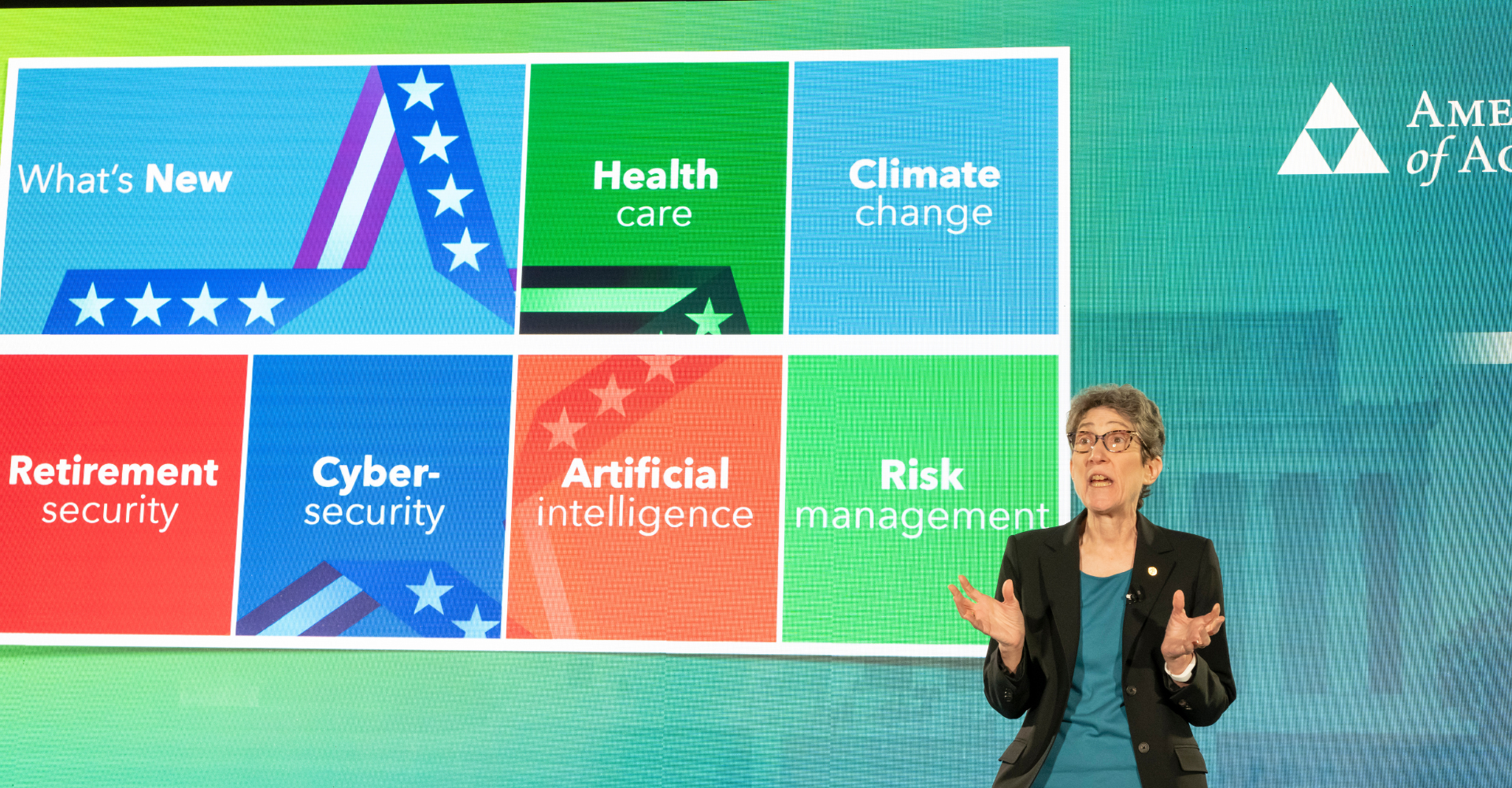

I focused on mega issues like climate change, Social Security and retirement income, Medicare and health insurance, and cyber risk and insurance— all areas with significant weight for both actuaries and the public we serve through the Academy.

That weight is amplified today by the knowledge that tens of millions of Americans will soon cast ballots (and some have already!) for this year’s elections that will shape important dialogues on these mega issues going forward.

In whatever way the election unfolds, the Academy will continue to play a significant role in providing our profession’s expertise to policymakers and regulators, rooted in nonpartisan and objective actuarial science and principles.

Just as an individual vote may seem inconsequential but is not, from our own individual corners of the actuarial world we may feel like we’re not making a difference— but as your Academy President, I’m here to share my perspective on how you do and can make a difference through the Academy.

I’d like to tell you a story. It’s about what I call the Wow of the prodigious output of the Academy and the difference it makes. Along the way, I’m going to talk about the importance of communication in pursuing the Academy’s mission, and offer a few personal musings — but I promise, not too many.

What I’ve seen is that the large quantity of high-quality work (the Wow) that the Academy produces serves the public in a substantive way that puts the profession’s best foot forward. The Academy presents our profession’s perspective on a wide range of issues and challenges, including the mega issues but also many others. They range from:

National issues, like the financial health and other areas of needed attention in public programs like Social Security and Medicare; and

Climate change, its effect on financial security systems, and how the risks posed to those systems are understood and communicated; to

State issues, like exploring paths forward for better modeling of natural catastrophes affecting millions in California; to

Implementation of insurance anti-discrimination laws in Colorado; and

Addressing unintended bias in auto insurance right here in the nation’s capital.

This is just the beginning of a list that’s far too long to recount here that involves volunteer and staff work on hundreds of comment letters, issue briefs, policy papers, practice notes, presentations and webinars. The range of these efforts is a Wow, but there’s an even bigger one: The engagement that it creates. These efforts create a dynamic loop between us and stakeholders in the insurance, retirement, and risk spaces, prompting them to share their views and expertise and seek our advice. Take the mega-issues I mentioned, which are collected at our one-stop Election Issues Clearinghouse at actuary.org. We have widely shared many of the resources there— with policymakers, the news media and social media, and through new Academy channels like our Actuarially Sound blog. In turn, we have received great responses that inform and improve our work going forward.

In that way we keep the Wow/volume of our work product coming, therefore the loop.

This positive dynamic loop was no accident. The founders of the Academy were truly visionary in establishing an organization that makes explicit the connection between our profession’s work and the affairs of our national life. They had the insight that the systems that actuaries work on are of great consequence to our fellow Americans. And, just as significantly, that the time had come for a service organization of the whole U.S. actuarial profession dedicated to telling the story of how our work is connected to the interests of our fellow Americans. When we tell that story well, it resonates and stirs their engagement.

That brings me to the crux of my remarks today: Actuaries are not just scientists, but also communicators, even storytellers. There is no point to our work as actuaries or as the Academy unless we are able to communicate clearly what we mean in an understandable way. I don’t need to remind most of the audience that we even have an actuarial standard of practice, No. 41, Actuarial Communications. But I am fortunate to have learned the value— and the challenges— of communicating and storytelling even before I became an actuary.

For those of you who know my background, I was a Classics major in college, meaning that I studied ancient Greek and Latin along with the literature, history and art of the time period. Those of you who knew that, may have been waiting throughout the year for me to spout the one line of Greek that my college professor urged us to memorize to be able to recite at cocktail parties. I have moved beyond that and kept my obscure cocktail party comments focused on actuarial science. But what I have not moved beyond is the discipline of learning something difficult and in turn communicating that difficult thought or idea in a way that is clear to others so that they don’t say “it’s all Greek to me” (the classics equivalent of the “how long will I live” actuarial related cocktail party comment).

As actuaries, we work with models of varying levels of complexity to develop what in many circumstances is a single result – a number or a series of numbers that reflects an estimate of the financial consequences of an uncertain event.

(Okay, I am simplifying here). We are often tempted because we are so bound up in the models, to lead off a communication or discussion describing the model in detail rather than sizing up our audience and providing what they want and need to hear: an explanation of the results including a discussion of the limitations and uncertainty of the results that will be understood by the audience. Of course, the detailed explanations of the methodology will be put in the appropriate appendix or follow-up letter in order to meet our communication and documentation standards. I am not saying to skip that, only to make clear what our result is.

Not only is this important for the actuarial work products in our day jobs, but also in the Academy work products that we produce. An essential part of the Academy’s service— one that the Academy devotes great attention to— is ensuring that an understandable communication occurs. Our best work products are clear and in plain language so that the Academy’s audience – often non-actuaries with limited subject matter knowledge – are able to understand.

The work products tell a story, though perhaps not quite as dramatic as what I actually remember of my Greek studies – that is, the stories of Homer, Aeschylus and Sophocles.

As Academy members, we do want to tell the story communicating our profession’s approach to financial security solutions to the American people. And I believe we are doing that on an amazing scale that our founders would be proud of.

One advantage we have in telling the story is that we actuaries are participants and consumers in insurance and retirement systems beyond our individual practice areas. We are, dare I say, embedded in the story – personally and through the thousands of emails, texts, calls, Zooms, and meetings that are part of the Academy’s workstreams and that produce the Wows, the volume of work product. I’ve been impressed and grateful to see how Academy volunteers embrace being close to and working on these issues, because they want passionately to provide our expertise in more effective and more accessible ways to serve the public.

Public-facing apps and websites like the Academy’s Social Security Challenge, our joint Actuaries Longevity Illustrator with the Society of Actuaries, and the joint Actuaries Climate Index with SOA, the Casualty Actuarial Society, and the Canadian Institute of Actuaries, are helping to tell the story. Our testimony and participation before groups like the NAIC and the National Council of Insurance Legislators combine with our visits and sharing with Capitol Hill offices and agencies to engage state and national stakeholders. Our relationships with other actuarial organizations and affinity groups, our exploration of and continuing education on bias, the encouragement of a diversity of viewpoints and members and volunteers who reflect them, and our new Academy Learning portal launched just a few months ago, keep us moving forward. Wow, we are doing a lot pursuing our mission to serve the public (and to serve our profession).

Incredible what can be accomplished through service to others! We’ll certainly have a chance to hear more about exemplary service and its impact before lunch tomorrow through the words of our Myers and Farley Award recipients.

Their stories inspire us as to what the actuarial professional can accomplish through service. That term, “actuarial professional,” has special meaning for the Academy. The concept is part of the Academy’s own story dating back again to the founders, who saw the need for defining and supporting the actuarial professional independent of their own practice area or areas. Countless volunteers since then and today have shared in that vision, dedicated to building and supporting the professionalism framework of, for, and by the U.S. actuarial community.

Major milestones— some of the big Wows— in our own our self-regulation history included the establishment of the Code of Professional Conduct adopted by the five U.S. actuarial membership organizations, and establishment of the Actuarial Standards Board and the Actuarial Board for Counseling and Discipline within the Academy. This bedrock of the profession’s self-regulation provides the standards of conduct, qualifications, and practice that are the responsibility of each actuary to follow, as well as counseling and disciplinary functions for actuaries faced with professional challenges or potential Code violations. You can hear more about self-regulation and its importance during tomorrow afternoon’s closing general session.

It will be excellent; maybe even awesome; and I’m not saying that just because I will be a panelist!

The Academy’s recently published Competency Framework is another step forward in recognizing the actuarial professional, from any practice area, who holds the MAAA designation. Being versed in the General Actuarial Topics, U.S. Laws and Practices, and U.S. Actuarial Professionalism delineated in the framework will help new applicants satisfy the Academy’s updated membership requirements, which will be fully aligned with the framework starting in 2026. Just last month, the Academy shared information about the updates to the membership requirements for new members joining in 2026 and after, which will include an attestation to the knowledge described in the framework and the reinstatement of an experience requirement for members.

Existing members who continue their memberships beyond 2025 are grandfathered in and won’t need to attest to the updated requirements if they maintain their membership, but I encourage everyone to learn more at actuary.org and the FAQs posted there as we are all ambassadors for the profession and what it means to be an MAAA.

I want to close by thanking the many volunteers who have made important initiatives like the Competency Framework, and our many other efforts together on the journey of serving the public and the profession, a little bit easier. They include the Board of Directors, the many committee chairs and other volunteers I’ve had the pleasure of working with, and the incredible Academy staff led by our terrific Executive Director, Bill Michalisin. You are awesome and the volume of your work merits a Wow. I know that your continued dedication and efforts will ease the path for my successor and friend, Darrell Knapp, as he takes the helm of the Academy on November 13th. I hope you’ll be able to virtually join us for the presidential transition event and Annual Meeting of Members which will be held then in accordance with our bylaws. Even more, I urge you to “tell the story” like I have about the important public policy and professionalism issues of our day as an Academy volunteer and member, whether through committee service or through small projects you can help on, which we call micro-volunteering.

If you take anything away from this morning’s awards ceremony, and my remarks today, I hope it will be “I want to be part of the Wow” and help keep our financial system in the U.S. working for the public and for us as individuals.